Global Travel Key Themes for 2024: Resilient Recovery Amid Economic Uncertainty

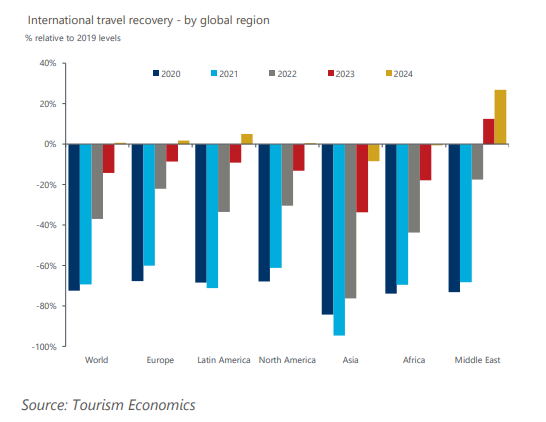

Global travel recovery will continue in 2024 despite a slower economic backdrop. Many countries that were previously expected to endure recession are now likely to avoid this although economic growth will certainly slow. The travel resilience in North America, Europe, and Middle East is set to continue as consumers continue to prioritise travel while Asia Pacific recovery will gain momentum. Global international visits are forecast to regain 2019 levels in 2024.

This research report expands on these key themes:

- Capacity constraints in China are easing and the recovery pace will further pick up. Initial recovery will favour the MEA and APAC regions, reflecting restored transport linkages and easier visa processes as well as perceptions of safety which has become a key factor in Chinese travel decisions. Outbound trips from China are expected to roughly double in 2024 but will remain around 20% below 2019 levels.

- Higher costs stemming from inflation, staff shortages and fuel prices have translated to higher travel prices for consumers, as post-pandemic balance sheets have reduced the ability for airlines and hotels to absorb costs. Combined with a weaker economic backdrop this will limit travel demand, especially in Advanced Economies. The recovery will not be derailed as consumers have demonstrated some tolerance towards higher prices, but they will be tested.

- The cruise sector will see continued recovery in 2024 as deployment schedules continue to improve. Cruise pricing plateaued in H2 2023, partly reflecting geopolitical impacts in the Middle East and Baltics regions. As pricing is a key lever in generating demand, we should see an end to the recent price increases over the next year as economic growth will slow, while cruise capacity will continue to rise with new ships deployed.

- Multiple major events are scheduled for 2024, including the Olympics in Paris, UEFA Championship in Germany and the T20 Cricket World Cup in US & Caribbean; these will present key opportunities for growth. Events bring a range of positive impacts including destination promotion, revenue uplift during the event-time and ultimately supporting jobs.

- Visitors will increasingly seek ‘authentic’ travel experiences next year, a growing trend that has emerged in 2023 with destinations more widely promoting unique and authentic travel experiences since the pandemic. Our Travel Industry Monitor (TIM) survey identifies that the top type of leisure travel in 2024 will fall within the ‘cultural and experiential’ category, as visitors seek more activities and experiences beyond destination resorts.

Tags:

Related Services

Service

Global Travel Service

Detailed travel and tourism market trends and forecasts for 185 countries globally.

Find Out More

Service

Global City Travel

Detailed and comparable inbound and outbound travel intelligence for 300+ cities globally.

Find Out More

Service

International State Travel

Travel data covering international visits and nights by source country to the 50 states of the USA.

Find Out More