Commodities Key Themes 2024 – Another year of price weakness for metals

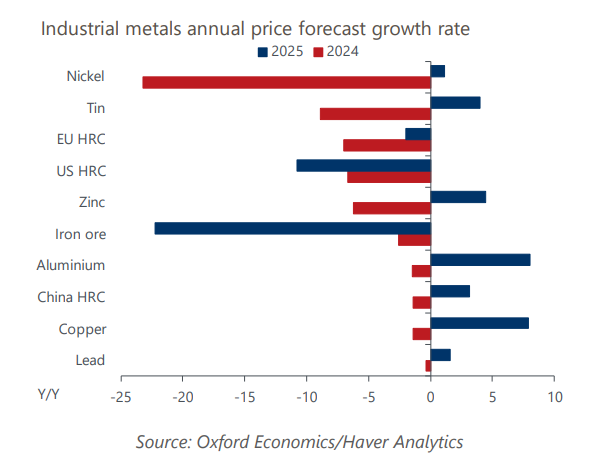

We expect another year of industrial metal price weakness in 2024 and are generally below consensus. Metal demand will remain weak in H1 while supply continues to increase. However, metal prices will gradually increase later in the year and beyond as demand recovers.

This research report expands on these key themes:

- Weak metal demand will weigh on prices next year as the full impact of high interest rates weighs on metal-intensive sectors such as construction and capital-intensive manufacturing sectors like transport equipment and machinery. But we forecast industrial production to improve over 2024, especially in the US and Europe as central banks start to cut rates in H2. Consequently, metal demand and prices will rise going into 2025.

- The energy transition will continue to accelerate demand, with robust production of EVs and renewable power generation capacity expected. Demand for metals such as copper, aluminium and other battery metals will surge, driving prices higher.

- We forecast the US dollar will remain strong next year, weighing on US dollar denominated metal prices in H1. However, as US interest rates fall later in 2024, we see the dollar weakening, providing further stimulus to metal demand and prices in 2025.

- We expect input costs to ease next year, supporting the most energy-intensive metal production such as aluminium, zinc and steel. However, energy costs will remain above historical averages, so metal production in high costs regions such as Europe may struggle.

- We anticipate most metals will see continued supply strength next year, as previous investment comes online driving market surpluses wider. Nickel is the most notable example and will be the worst performing metal.

- However, growing political unrest towards miners, particularly in South America, poses a risk for supply and prices. Furthermore, El Niño could also precipitate severe weather disruption at mines and transport networks in 2024.

Tags:

Related Services

Service

Global Industry Service

Gain insights into the impact of economic developments on industrial sectors.

Find Out More

Service

Sectoral Climate Analysis

Assess the impacts of climate change and mitigation policies for more than 100 sectors

Find Out More

Service

Global Industry Model

An integrated model covering 100 sectors across 77 countries and the Eurozone.

Find Out More