Big shifts are underway in Russia-China trade

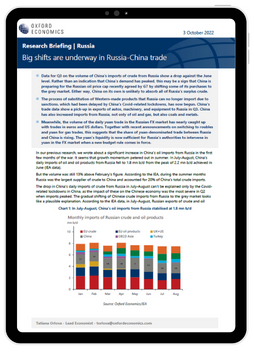

Data for Q3 on the volume of China’s imports of crude from Russia show a drop against the June level. Rather than an indication that China’s demand has peaked, this may be a sign that China is preparing for the Russian oil price cap recently agreed by G7 by shifting some of its purchases to the grey market. Either way, China on its own is unlikely to absorb all of Russia’s surplus crude.

What you will learn:

- The process of substitution of Western-made products that Russia can no longer import due to sanctions. which had been delayed by China’s Covid-related lockdowns, has now begun. China’s trade data show a pick-up in exports of autos, machinery, and equipment to Russia in Q3. China has also increased imports from Russia, not only of oil and gas, but also coals and metals.

- Meanwhile, the volume of the daily yuan trade in the Russian FX market has nearly caught up with trades in euros and US dollars. Together with recent announcements on switching to roubles and yuan for gas trades, this suggests that the share of yuan-denominated trade between Russia and China is rising. The yuan’s liquidity is now sufficient for Russia’s authorities to intervene in yuan in the FX market when a new budget rule comes in force.

Tags:

Related Services

Service

China Cities and Regional Forecasts

Quarterly updated data and forecasts for 286 cities and 30 provinces across China.

Find Out More

Service

Asian Cities and Regional Forecasts

Key economic, demographic, and income and spending projections to 2035 for more than 400 locations across Asia-Pacific.

Find Out More

Service

Commodity Price Forecasts

Monthly reports on commodity price trends and forecasts, as well as weekly briefings on the latest price action.

Find Out More