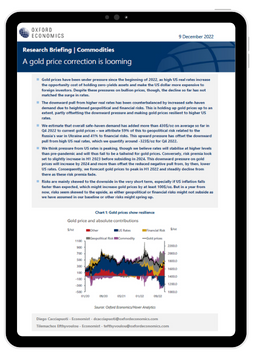

A gold price correction is looming

Gold prices have been under pressure since the beginning of 2022, as high US real rates increase the opportunity cost of holding zero-yields assets and make the US dollar more expensive to foreign investors. Despite these pressures on bullion prices, though, the decline so far has not matched the surge in rates.

What you will learn:

- The downward pull from higher real rates has been counterbalanced by increased safe-haven demand due to heightened geopolitical and financial risks. This is holding up gold prices up to an extent, partly offsetting the downward pressure and making gold prices resilient to higher US rates.

- We estimate that overall safe-haven demand has added more than 430$/oz on average so far in Q4 2022 to current gold prices – we attribute 59% of this to geopolitical risk related to the Russia’s war in Ukraine and 41% to financial risks. This upward pressure has offset the downward pull from high US real rates, which we quantify around -323$/oz for Q4 2022.

- We think pressure from US rates is peaking, though we believe rates will stabilise at higher levels than pre-pandemic and will thus fail to be a tailwind for gold prices. Conversely, risk premia look set to slightly increase in H1 2023 before subsiding in 2024. This downward pressure will increase by 2024 and more than offset the reduced negative pull from, by then, lower US rates. Consequently, we forecast gold prices to peak in H1 2022 and steadily decline from there as these risk premia fade.

Tags:

Related Services

Service

Global Commodity Service

Monthly reports on commodity price trends and forecasts, as well as weekly briefings on the latest price action.

Find Out More

Service

Global Industry Service

Gain insights into the impact of economic developments on industrial sectors.

Find Out More

Service

Industry Scenarios

Quantifying the impact of policy changes and other risk events on industrial sectors.

Find Out More