Research Briefing

| Jan 11, 2024

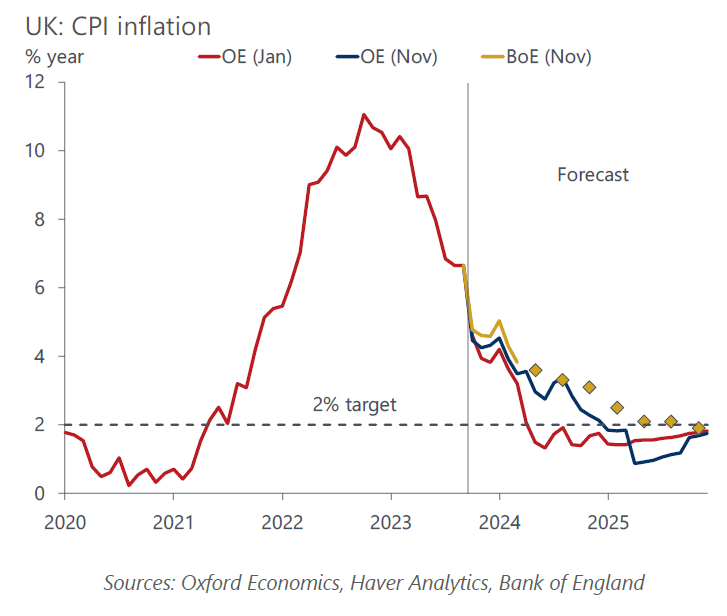

Three reasons why UK inflation will swiftly return to target

The UK inflation outlook has been transformed by steep falls in oil and gas prices and the recent softening in core price pressures. We now expect CPI inflation to average 2.1% in 2024, down from our November forecast of 3.1%. Inflation is on track to return to the 2% target in April.

What you will learn:

- Wholesale gas prices have fallen sharply in recent weeks and the Ofgem energy price cap is on track to fall by 12% in April. Our commodities team has also cut its forecast for oil prices following recent declines. We expect these two categories to knock more than 1ppt off CPI inflation in 2024, with the drag in April being as high as 1.6ppts.

- Services inflation has been softer than anticipated in recent months. Though high inflation has pushed up wages, the final part of the loop back to prices hasn’t become properly established. The fall in commodity prices should further weaken the link between wages and prices, reducing the risk that high inflation becomes engrained.

- Even before the recent falls in oil and gas prices, the Bank of England’s inflation forecasts had looked too high. We expect the BoE to lower its projections significantly in February’s Monetary Policy Report, as it begins to prepare the ground for rate cuts. Lower inflation means we also expect stronger growth in real household incomes and GDP this year.

Tags:

Related Services

UK Macro Service

Track, analyse, and react to macro events and future trends in the United Kingdom.

Find Out More

UK Region and LAD Forecasts

Regularly updated data and forecasts for UK regions and local authority districts.

Find Out More

European Macro Service

A complete service to help executives track, analyse and react to macro events and future trends for the European region.

Find Out More