Three key trends to watch in the global economy in 2026

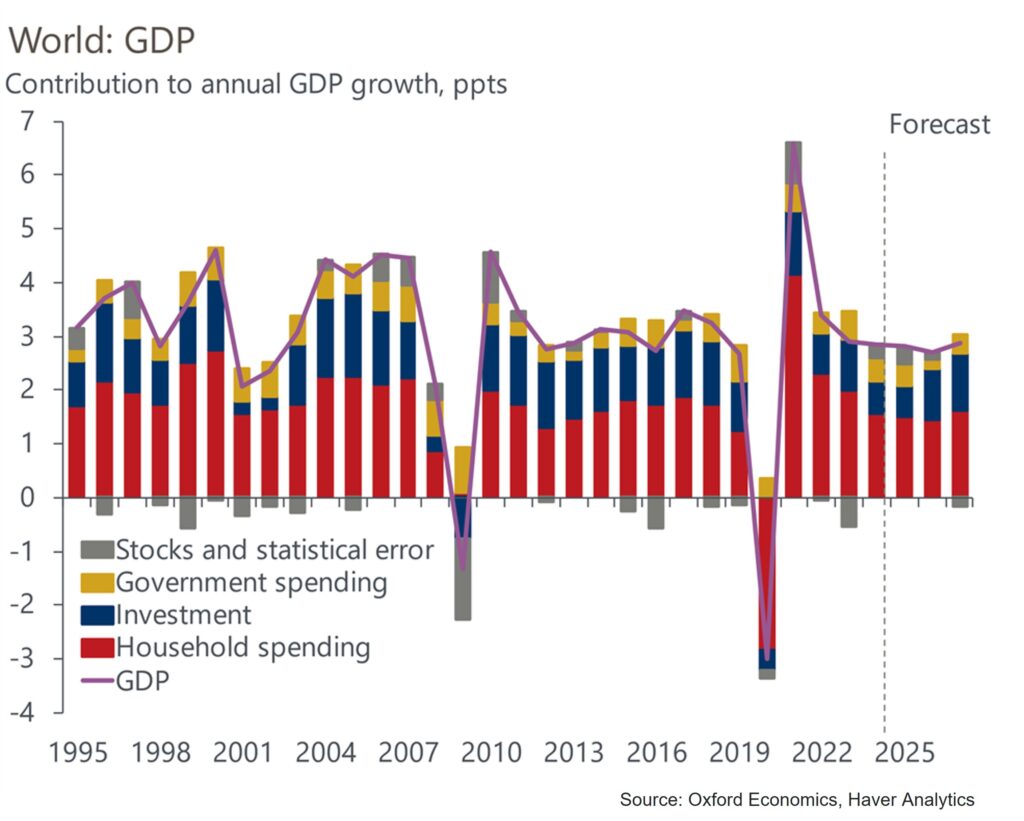

Global economic conditions proved more resilient in 2025 than many feared. Despite uncertainty following Donald Trump’s presidential victory, global GDP growth remained steady at around 2.8%, exactly in line with our forecast.

As we look ahead to 2026, the global economic outlook is shaped by several unique forces that make the timing and magnitude of their impacts difficult to read. Below, we unpack the three global themes that will define 2026 and outline what they mean for the economic outlook.

As we head towards another new year, our view remains that US economic exceptionalism will continue in 2026. Sign up for our Global Key Themes webinar on 4 Dec to learn more.

Sign Up2026 Key theme 1

New global trade order – Act II

Much of the uncertainty in 2025 centred on the scale of US tariff increases. Today, the bigger question is no longer how high US tariffs will rise, but what the knock-on effects of sustained high US tariffs will be.

For the US, we do not expect tariffs to significantly dampen its domestic activity. Strong household incomes and ongoing fiscal loosening should allow US exceptionalism to continue in 2026.

However, we expect tariffs to have a more sustained dampening impact on US imports than the consensus, limiting the spillovers of US domestic strength to the rest of the world.

Despite facing very high US tariffs, overall Chinese exports have continued to grow at a reasonably healthy pace. We expect this to continue into 2026 as authorities continue to promote manufacturing-led growth. This is likely to push down Chinese export prices further as firms seek to export additional production.

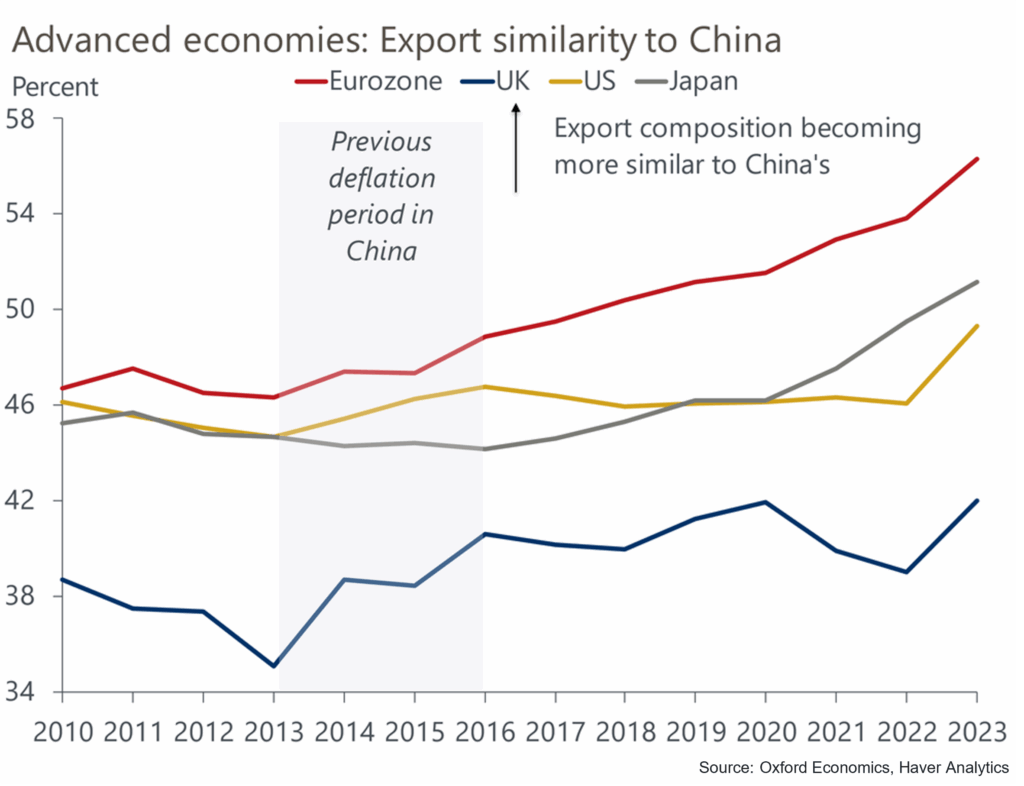

The latest deflationary episodes may have more adverse spillovers for advanced economies than previous periods of falling Chinese prices. The shift in China’s export basket since the last disinflationary episode in the mid-2010s towards higher value-added products has put Chinese firms in more direct competition with producers in North-East Asia and Europe. Falling Chinese prices will thus only add to competitive pressures for manufacturers in both regions.

The shift in China’s export composition poses a greater risk to advanced economies

2026 Key theme 2

AI as shock absorber or shock magnifier?

In 2025, rapid growth in US AI-related capital spending has offset weaker growth elsewhere in the economy and has given a significant boost to Asian computer and semiconductor producers. But the path forward looks more volatile.

While concerns about AI bubbles have surfaced, we think that there is scope for tech investment as a share of GDP to hit fresh record highs, rather than remain broadly flat in line with our baseline. In our upside scenario, this additional strength along with some other positive spillovers, results in US GDP growth of 3% in 2026, far higher than our well-above-consensus baseline forecast of 2.3%.

However, risks lie in both directions. The AI boom is arguably entering a more vulnerable phase. Financing is shifting from cash to debt. Concerns about an AI downturn is a well flagged risk in our client surveys. In our downside scenario, which is modelled on the dot com bust, a sharp slowdown in AI investment and falling stock prices triggers a slowdown in US GDP growth to below 1% next year.

2026 Key theme 3

It’s all about the fiscal impulse

While monetary policy tends to dominate economic debate, its role in shaping growth surprises in 2026 is likely to be limited. Interest rate cuts are expected to proceed gradually toward neutral levels and the exact path is unlikely to have any meaningful impact on economies’ 2026 growth trajectories.

Instead, fiscal policy surprises will matter more.

Despite growing concerns about fiscal sustainability in the US, UK and parts of Europe, we are sceptical that any fiscal surprises next year will inevitably be in the form of additional tightening. While some advanced economies’ debt ratios will climb, the pick-up will be gradual. Against this backdrop, as long as governments have a credible medium-term plan, markets are unlikely to harshly penalise them for any signs of minor fiscal slippage. Our baseline forecasts assume that the global fiscal impulse will be slightly positive next year, driven mainly by China. We think the risks are tilted towards even more supportive fiscal policy, especially in the US and China.

Global outlook in 2026: Stable on the surface, uneven beneath

Taken together, these themes point to an outlook where global growth remains stable but unremarkable. We forecast world GDP growth of 2.7% in 2026.

But beneath that steady headline, important divergences are set to widen:

- The US stays out in front, even amid AI uncertainty.

- China stabilises but shifts competitive pressure toward advanced economies.

- The Eurozone and Japan lag, with structural challenges becoming more evident.

- Fiscal policy, not interest rates, will be the key swing factor.

The stability suggested by the top-line numbers masks a more complex reality beneath the surface. Understanding these underlying forces, and the risks and opportunities they create, will be essential for navigating the global economy in 2026.

We will publish our Key Themes 2026 series in the upcoming weeks. To be the first to access these reports and webinars, register your interest today.