May you live in interesting times in US

The first release of the November baseline incorporated the election outcome, but in interesting and uncertain times, our baseline assumptions require more frequent updates to stay current with the evolving balance of risks.

What you will learn:

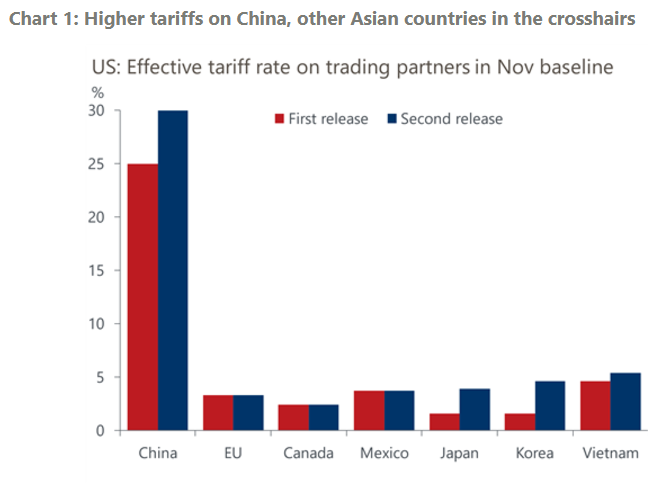

- We adopted more protectionist measures in the second release of the baseline. We assume 30% blanket tariffs on China with additional Asian countries in the crosshairs. In our view, risks to our tariff assumptions are now in better balance than before.

- To the upside, tariffs may end up lower than expected if the president-elect remains attuned to the stock market, and the leading candidate to head the Treasury Department pushes back against Donald Trump’s protectionist instincts.

- To the downside, tariff hikes could easily be more severe and swifter than anticipated as history is rife with examples of presidents erecting trade barriers early in their terms. Also, the politics of tariffs seem favorable.

- Record container activity at the Port of Long Beach speaks to a strong consumer and jitters ahead of a potential port strike in mid-January. We will monitor this metric to gauge whether firms are actively preempting potential changes to trade policy under the new administration.

- Upside risks to inflation from medical care seem less glaring over the medium term as labor constraints are becoming less binding in the sector.

Tags:

Related Posts

Post

US Key Themes 2026: Exceptionalism amid fragmentation

US exceptionalism is alive and well, and that won't change in 2026.

Find Out More

Post

US Bifurcated ꟷ Economic backdrop deepens racial disparities

Black and Hispanic households have experienced more inflation than other groups since the reopening of the economy from the pandemic lockdowns. Although there've been many phases of high inflation, some have disproportionately hurt these minority groups, such as the jump in energy prices following Russia's invasion of Ukraine, with the ensuing surge in rental inflation further setting them back.

Find Out More

Post

US economic outlook 2026: Four key calls for the year

US exceptionalism will continue in 2026—but so will the vulnerabilities beneath the surface.

Find Out More