Research Briefing

17 Oct 2025

France’s debt burden is set to become much heavier

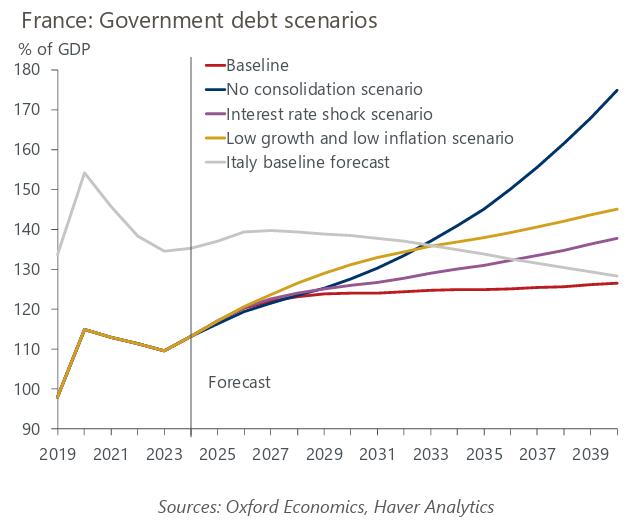

By 2035, we expect France’s public debt to approach 125% of GDP, up from 113% in 2024 and among the highest in advanced economies.

By 2035, we expect France’s public debt to approach 125% of GDP, up from 113% in 2024 and among the highest in advanced economies. Given the current political impasse, meaningful fiscal consolidation is unlikely before the 2027 presidential election. Even after that, we expect it to be gradual, keeping debt on an upward path and France’s vulnerability to shocks elevated.

What you will learn:

- France’s favourable past debt dynamics have masked its persistent fiscal slippage versus peers such as Italy. Since its borrowing costs are now higher and its potential growth is weaker, France’s debt dynamics are deteriorating. Delaying fiscal consolidation only increases the sharpness of the eventual adjustment that will be needed.

- Our already negative baseline is overwhelmingly surrounded by downside risks that could compound, raising the need for an ECB backstop. A prolonged political deadlock that prevents fiscal consolidation could push debt to around 145% by 2035, above Italy’s 138%.

- Other risks are also adverse. Higher interest rates prompted by weak fiscal consolidation, political shocks, or wider term premia could, in isolation, add about 6ppts of GDP to 2035 debt. Medium-term growth risks are also negative: political paralysis could stall reforms, curbing investment and hiring. A weak growth and low inflation path would lift debt around 13ppts above our baseline by 2035.

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]