Research Briefing

| Nov 13, 2023

Eurozone: Why consumer spending is stuck in the doldrums

We expect weak consumer spending in the eurozone to persist throughout 2023 and into early 2024. Consumption has mainly been held back by high inflation and falling real incomes in the last 12 months, but we think tight monetary policy has now taken over as the main drag on household spending.

What you will learn:

- Intertemporal substitution – households’ spending versus saving decisions – is the main channel through which tight monetary policy is dampening consumption. Higher interest rates have made returns on savings more attractive for households. They are also weighing on debt-financed consumption of durables, as evidenced by households’ depressed major purchase intentions.

- The near-term outlook for private consumption is precarious. Confidence has again taken a turn for worse, while real incomes are just barely rising despite inflation coming down. Resilient labour markets are preventing the situation from worsening, but we still expect consumption to remain near-stagnant in H2 and 2023 overall.

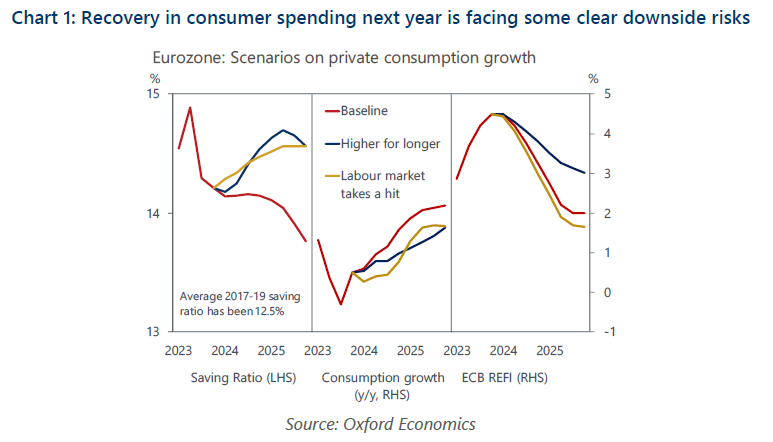

- The tide should turn in 2024, but it will be gradual. We expect real income growth to pick up more forcefully next year, and we still think the ECB will cut rates earlier than the market expects. The key question is how quickly consumers – still scarred by the difficulty of the past three years – will respond. A faster unwinding of the large – and still growing – stock of savings is an upside risk to our baseline forecast.

- But our analysis suggests the pace of recovery in private consumption could disappoint next year. Potential triggers could be higher-for-longer ECB rates, further dampening credit conditions and amplifying the intertemporal substitution effect, and a weaker labour market could affect real disposable income, while prompting households to build up more precautionary savings.

Tags:

Related Services

Service

European Macro Service

A complete service to help executives track, analyse and react to macro events and future trends for the European region.

Find Out More

Service

European Cities and Regions Service

Regularly updated data and forecasts for 2,000 locations across Europe.

Find Out More