Research Briefing

| Apr 22, 2024

Equities Quick Take: Sentiment sours but earnings provide support

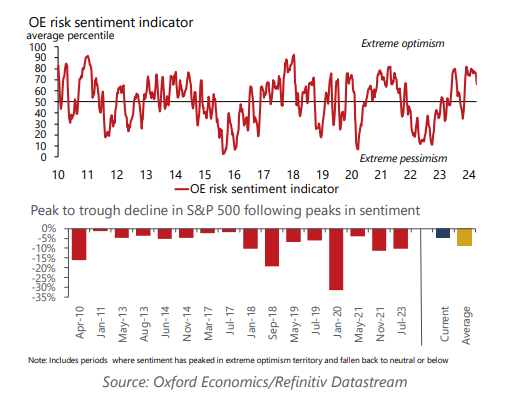

Equities are under pressure following this month’s stronger-than-expected US inflation print. We see scope for some further weakness in the near term as sentiment unwinds, but think the market is being underpinned by a broadening earnings recovery.

Tags:

Related Reports

Click here to subscribe to our asset management newsletter and get reports delivered directly to your mailbox

Trumponomics – the economics of a second Trump presidency | Beyond the Headlines

The 2024 US Presidential Election is less than seven months away. In this week’s Beyond the Headlines, Bernard Yaros, Lead Economist, outlines two scenarios for the US economy if former President Donald Trump returns to the White House and Republicans sweep Congress.

Read more: Trumponomics – the economics of a second Trump presidency | Beyond the Headlines

Economics for Asset Managers

Read more of our analysis and reports on asset management and economic outlook.

Read more: Economics for Asset Managers