City consumers in emerging Asia lead global growth in spending

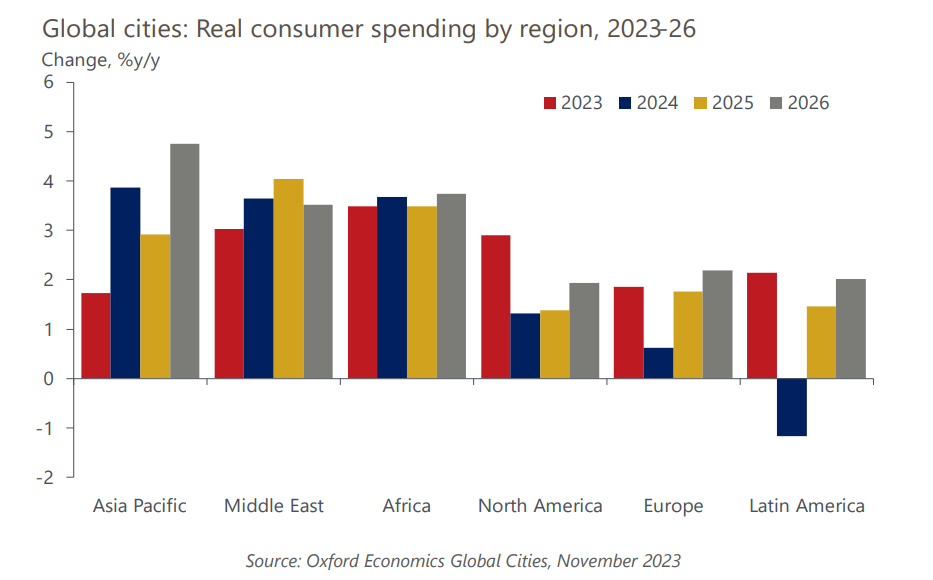

Global urban consumers have faced numerous difficulties in recent times, and the near-term outlook looks challenging still. Rising interest rates will take over from high inflation as the main drag in the short-term consumer outlook. Many advanced cities in the world, including New York, London, and Paris are expected to record near-negligible rates of consumer spending growth in 2024. Despite the pressures, however, many cities in emerging Asia, Africa, and the Middle East are still forecast to achieve significant growth in consumer spending next year and into 2025-26.

What you will learn:

- While inflation has been falling, the lagged effects of tighter monetary policy on increased saving intentions and higher lending and debt repayment costs are expected to drag on the consumer outlook in advanced cities in Europe, North America, and Asia in 2024 before we see signs of reprieve in 2025-26. Within the categories of spending, however, there remains opportunities for growth, such as in healthcare.

- Over the next three years emerging Asian cities will see the strongest rates of growth in consumer spending. But while spending growth amongst urban consumers in Southeast Asia and India are forecast to impress, it will be under pressure in Chinese cities amid the real estate downturn.

- African cities are also expected to exhibit some of the fastest rates of consumer spending over the short term. Driven largely by their strong demographic growth, spending growth among some African cities is expected to far outstrip that of other cities around the world. Yet the composition of that growth will largely be among the non-discretionary consumption categories.

Tags:

Related Services

Service

China Cities and Regional Forecasts

Quarterly updated data and forecasts for 286 cities and 30 provinces across China.

Find Out More

Service

Asian Cities and Regional Forecasts

Key economic, demographic, and income and spending projections to 2035 for more than 400 locations across Asia-Pacific.

Find Out More

Service

Global Cities Service

Make decisions about market and investment strategies with historical data and forecasts for 900 of the world’s most important cities.

Find Out More