2025 year in review: What we got right and what we didn’t

As we head into 2026, our attention is turning to the key themes for next year. But how did our key calls for 2025 pan out? And what can we learn from our forecast misses for the year ahead?

In this blog, we compare our forecasts from December 2024 with our current estimates of growth and inflation to see what we got right, what we got wrong and what we need to learn to do better next year.

US exceptionalism holds in 2025

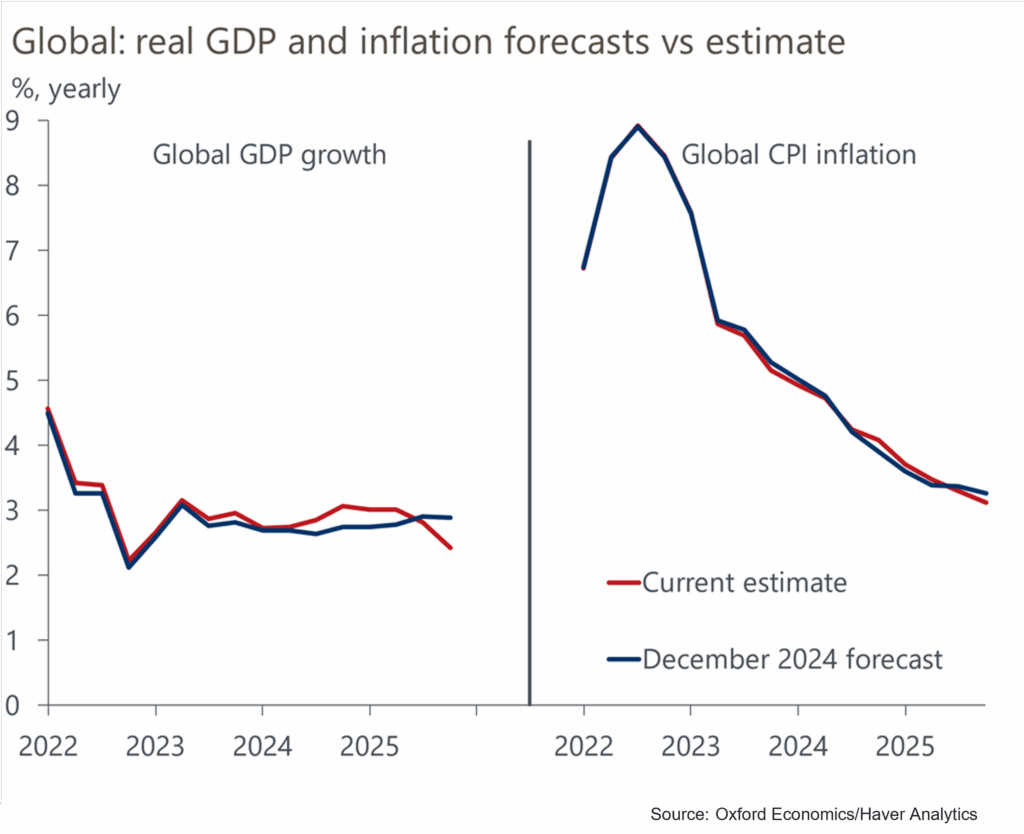

So far, 2025 has panned out largely as we had expected in our key calls at the end of last year. Despite volatile policy this year, our December 2024 forecasts for global GDP growth and inflation proved to be pretty accurate, growth has stayed pretty flat at subdued levels and inflation has eased gradually.

Our forecasts for global GDP growth and inflation proved accurate in 2025

Our main theme for 2025—that US growth exceptionalism would persist—proved correct. A combination of the AI-driven investment boom and strong spending by high-income consumers kept growth at 2%, outperforming consensus expectations though slightly below our own.

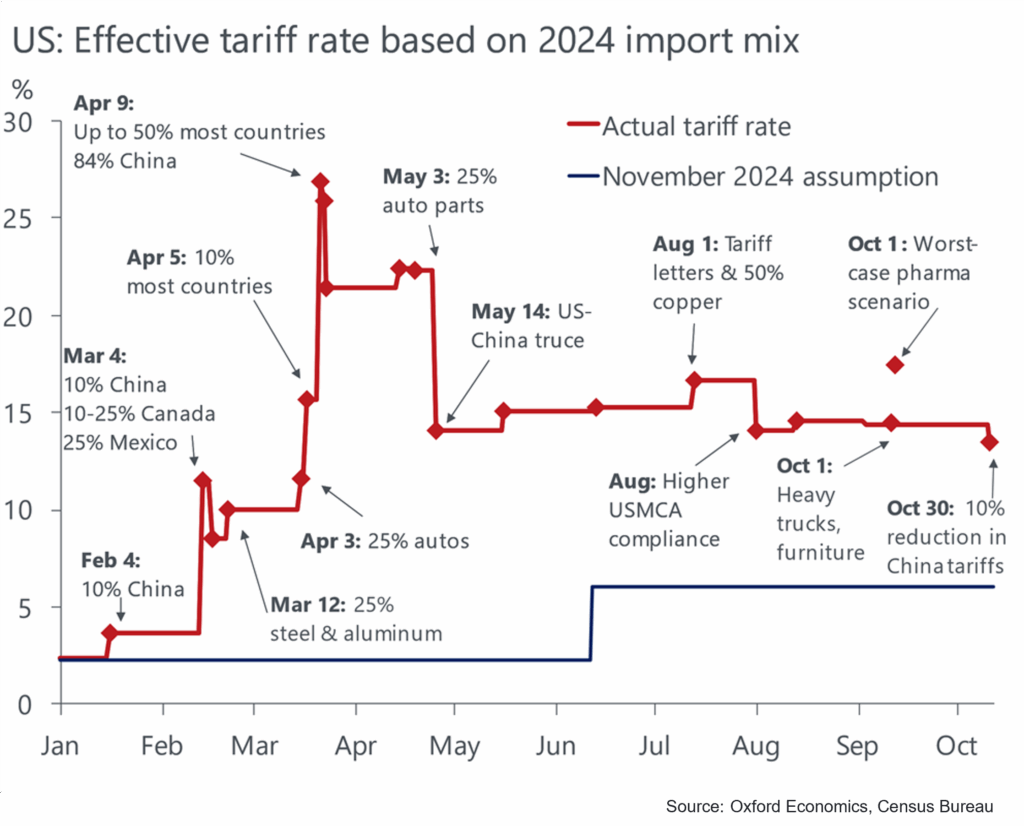

However, the scale of President Trump’s tariff measures went far beyond expectations. We had expected the effective tariff rate to rise to around 6%, but protectionism intensified well beyond that. Even so, we remained less concerned about the risk of a US recession, despite market pricing implying a 60% probability of a global downturn following “Liberation Day.”

Despite the shock, world trade and industrial production have held up remarkably well. World goods trade grew by an estimated 4%, exactly in line with our forecast at the end of last year. Global industrial production increased by 2.6% compared with our forecast of 2.9%. That has been largely a result of the factors we identified last year combining.

China’s resilience vs. Germany’s struggles

Among major economies, China emerged as the surprise outperformer of 2025, while Germany stood out as the key underperformer.

China’s economy grew by 4.8%, beating our expectations of 4.5%. That upside surprise was almost entirely driven by resilient exports, as the country adapted to higher US tariffs by deepening trade ties with emerging markets and moving further up the value chain. Its investment and consumption trends stayed broadly in line with our forecasts, but net exports provided the unexpected boost.

But what has been a source of upside surprise for China has also—arguably—been the cause of downside surprise for Germany. Even our below-consensus call of just 0.5% growth in 2025 looks to have been too hopeful this year, with our current estimate at just 0.2%. Germany’s industrial malaise has many causes, including structurally uncompetitive energy prices, tariffs, and a backloaded fiscal response, but some of the weakness is down to China’s emergence over the past two decades as a competitor in advanced economy export markets.

This point is central to our thinking for 2026. China’s recent doubling down on support for the industrial and export pillars of the economy as engines for growth has led us to raise our forecasts for China, while we remain pessimistic on Europe’s industrial recovery. In time, this could give rise to the next wave of protectionism, this time outside the US.

Inflation: Stickier than expected

While inflation has gradually fallen, it proved stickier in advanced economies than even our cautious forecasts assumed. We had correctly anticipated that tight labour markets and supply disruptions would keep upward pressure on prices. However, we underestimated how sticky prices would prove in the face of tariff-induced supply shocks and US immigration restrictions.

This stickiness forced major central banks to stay hawkish for longer. The Federal Reserve, in particular, held rates 25–50 basis points higher than our forecast, delaying cuts until late in the year.

Even so, our call to stay underweight duration proved right, as long-term yields remained elevated. However, our expectation that inflation swaps would rise sharply—echoing the “Trump 1.0” playbook—didn’t materialise, as markets focused more on growth risks than inflation resurgence.

FX and markets in 2025: Politics-driven volatility

2025 has been a chastening year to be forecasting the US dollar. We’ve long expected a gradual dollar depreciation, and 2025 finally delivered part of that move. In Q2 in response to questions over the enduring quality of US policy institutions and volatile policy. We never believed the narrative that this had a broader read across to the dollar’s reserve status, which has proved correct.

Our strategists proposed to stay clear of a directional dollar view and instead suggested going long cyclical currencies (EUR and EUR satellite currencies) versus short a basket of commodities FX (MXN, CAD, etc). This view performed well, particularly in H1. We also correctly identified the weakness of the yen and sterling, two currencies that we thought would suffer from economic policy gyrations.

On markets, we were right to stay positive on equities and underweight duration, but wrong to look beyond tech stocks and to expect a substantial broadening of the equity rally to US small caps. The ongoing bifurcation of the US and global economies means investors will need to use a discerning eye to take advantage of macro themes.

Lessons for 2026

The biggest takeaway from 2025 is clear: volatile trade policy is reshaping global macro dynamics. Tariff shocks, fiscal shifts and supply chain realignments are increasingly driving divergences between regions. Fortunately, our trade scenarios provided a good foundation on which we could pivot the forecast through the year.

Looking ahead, economic policy volatility will remain a defining theme. Tariffs and anti-competitive measures could rise further, especially if Europe’s tolerance of China’s export-led growth wanes.

We’ve incorporated new insights into how tariffs affect the modern global economy, refining the trade levers in our Global Economic Model to respond more dynamically to such shocks. History tells us that protectionist policies tend to trigger a ripple effect across the world economy, and we stand ready to speedily incorporate further changes to trade policy into our forecasts and scenarios.

The transformation of trade and fiscal policy is far from over. Our 2026 forecasts will reflect the shift to far more malleable economic policy and this new era of policy-driven volatility and adaptive resilience.

We will publish our Key Themes 2026 series in the upcoming weeks. To be the first to access these reports and webinars, register your interest today.