Research Briefing

11 Nov 2025

The Green Leap: Unlocking climate financing at COP30 for Africa

The scaling of climate finance for developing countries will take centre stage at the 30th Conference of the Parties (COP30) of the UN Framework Convention on Climate Change (UNFCCC) starting today, in Brazil. Leaders will grapple with how to plug the gaping shortfall in funds needed to help developing economies curb emissions and adapt to climate shocks.

Reforming the global financial architecture will be a key discussion.

What you will learn:

- The creation of a ‘green IMF’– a global climate finance coalition linking funding to emission cuts – and continued backing for the Bridgetown Initiative, which champions fairer lending terms and debt relief for climate-vulnerable countries, are some of the bold moves that leaders at COP30 could support to catalyse climate finance in Africa.

- At last year’s COP29 in Azerbaijan, wealthy countries made a new pledge of at least $300bn a year by 2035 to the developing world. Yet even this ambitious-sounding target pales in comparison to the trillions required.

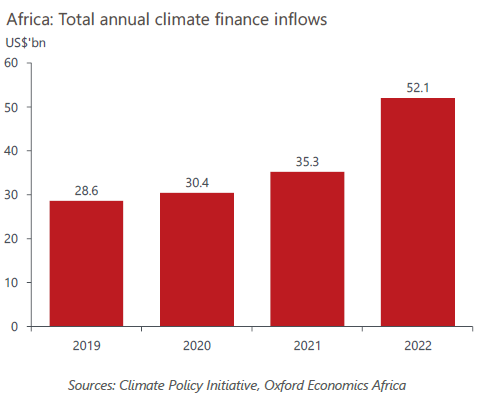

- Although Africa bears the brunt of climate change impact, it received just $52bn in 2022, a fraction of the at least $190bn needed yearly to meet the continent’s climate goals. Worse still, funds are concentrated in fewer than a dozen countries and skewed toward mitigation projects, leaving adaptation in the lurch.

- Most of Africa’s climate funding comes from public lenders and concessional loans, adding to already heavy debt loads. High costs and weak credit ratings deter private investors. De-risking climate investment will be vital to unlocking private capital and closing the continent’s massive funding gap.

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]