Asia Chip Export Index

An early signal of turning points in the semiconductor cycle

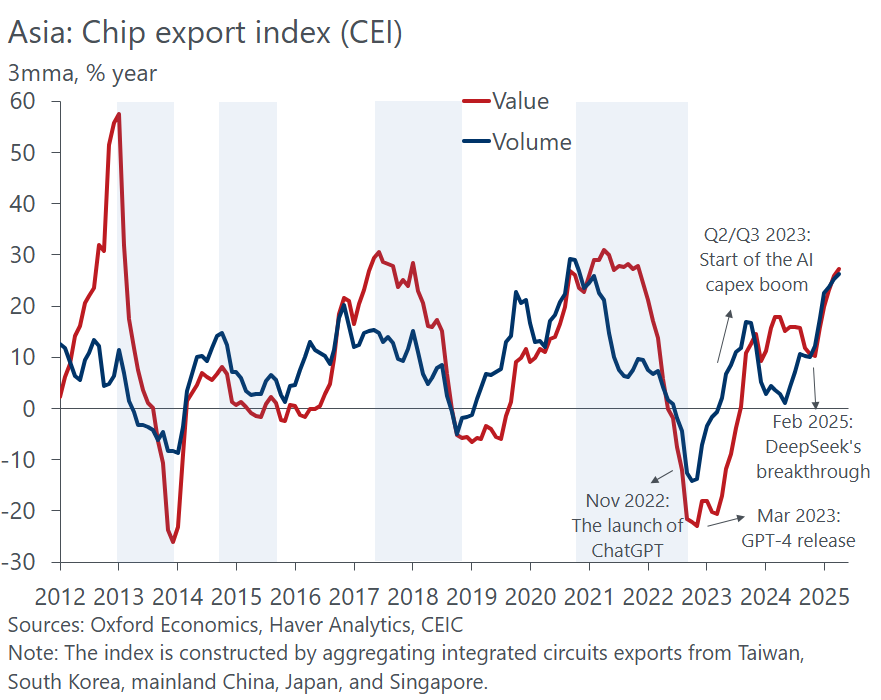

The Oxford Economics Asia Chip Export Index (CEI) aggregates monthly integrated circuits exports data in both value and volume terms for key Asian economies, providing an early indicator of whether the global chip cycle is approaching a peak or a trough.

Sep 2025 update

26.2% ↑

CEI Volume Growth

17.3% ↑

CEI Value Growth

Key insights

Our Asia Chip Export Index (CEI) has accelerated over the past three months, rising by 27.3% y/y in value and 26.2% y/y in volume in August.

- Cyclical factors should provide near-term support for chip exports, with holiday orders ahead of the Christmas period gradually feeding into export demand. We expect the recent launch of new devices from leading tech companies like Apple (Samsung is likely to follow suit early next year) to sustain chip demand, too, partly due to the integration of AI technology.

- AI-related policy is likely to provide a structural boost. Significant policy developments in the AI sectors in the US and China could govern the outlook for Asia’s exports. The US is pursuing a comprehensive approach aimed at controlling the entire AI value chain. Meanwhile, China is prioritising ‘AI+’ integration, focusing on embedding AI into industry and commerce to drive productivity gains. The traditional division of roles between the two superpowers – China as the primary producer and the US as the main consumer – may not hold for long.

- Rising demand from the two countries should benefit Asia’s electronics exports and create positive spillovers along the supply chain. The US approach is set to benefit traditional allies such as South Korea and Japan, whereas China’s more global orientation could deliver greater gains to emerging markets overall, particularly in ASEAN. Simultaneously, intensifying competition between the US and China increases the risk of bifurcated supply chains.

Download our report to learn more about the evolving roles of the US and China in semiconductors and AI, and the opportunities and risks these shifts present for Asia’s electronics sector.

Methodology: How we construct the Asia Chip Export Index

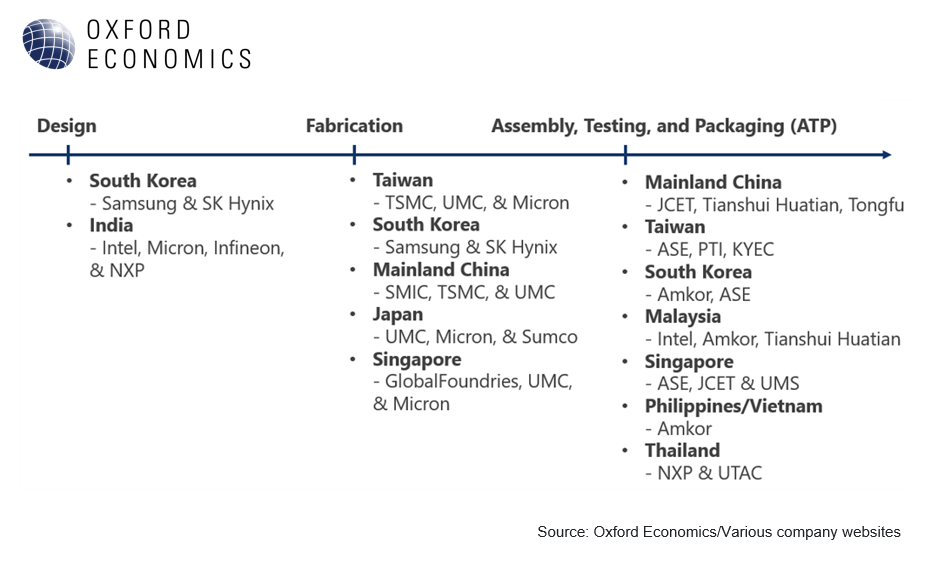

Asia sits at the heart of the global semiconductor supply chain. Of global semiconductor production capacity and supplies of key materials, 75% is concentrated in Asia. More notably, for the chips under 10-nanometres that are required to execute advanced AI functions, nearly all fabrication capacity is located in Asia.

Asia Chip Export Index is constructed by aggregating the monthly integrated circuits (IC; the key component of AI technology) exports data of specific Asian economies. These economies include Taiwan, South Korea, mainland China, Japan, and Singapore. We handpicked these economies based on several considerations. First, all these economies are at the front end of the AI supply chain, making them a forward indicator for the AI industry as they lead other electronic exporters in the region. Second, these economies consistently release their exports data ahead of the World Semiconductor Trade Statistics (WSTS)’s world semiconductor sales and regional peers’ export data releases. This offers an early indication of regional trade performance.

Note: As most Asian economies play significant roles in multiple processes in the semiconductor supply chain, the visualization only illustrates the general characteristics of each Asian economy.

How we can help

At Oxford Economics, we deliver:

- Forecasts and insights on countries, industries, cities and technology spending across Asia.

- Scenario analysis to help you quantify risks from trade policy, geopolitical tensions and shifting demand.

- Custom research and advisory to support your strategy in navigating the semiconductor cycle and managing your supply chain.