World Economic Prospects

Each month Oxford Economics’ team of 450 economists updates our baseline forecast for 200 countries using our Global Economic Model, the only fully integrated economic forecasting framework of its kind. Below is a summary of our analysis on the latest economic developments, and headline forecasts. To access the full report (and much more), request a free trial today.

Request a free trial

The soft end to 2025 won’t extend into 2026

- Annual global GDP growth has fluctuated within a tight 2.7%-3% range since the start of 2023 despite a swathe of economic shocks and a highly uncertain backdrop. We expect this phenomenon to continue next year and forecast world GDP will grow by 2.7% in 2026.

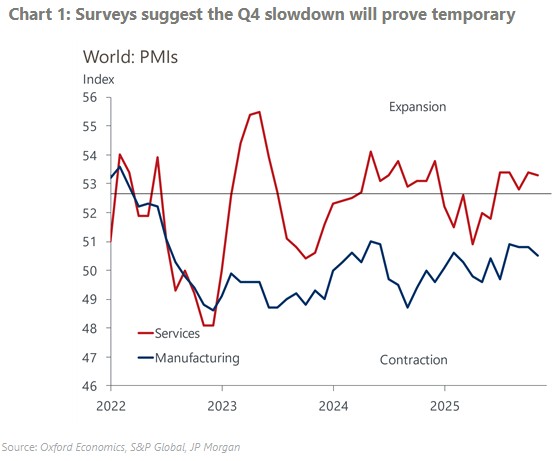

- Our estimates suggest that the global economy has ended 2025 on a soft note. The expected Q4 growth rate of 0.4% q/q would be the weakest outturn since 2022. However, we are sceptical that this marks the beginning of a period of sustained weakness.

- We have observed an upturn in some activity indicators, such as the JP Morgan Global Composite PMI, in the latter stages of this year. While we put little weight on the surveys as a near-term growth guide, there are other reasons to be believe that the end-of-year soft patch will prove temporary.

- A key driver of the US GDP growth slowdown from 3.6% q/q in Q3 to just 1% q/q in Q4 on an annualised basis is the elongated government shutdown. Some of the lost activity has already begun to be made up, a process which will continue early next year and should boost growth in Q1. We expect fiscal policy and the ongoing AI boom will continue to support growth. Our 2026 US GDP growth forecast of 2.5% is at the top of the consensus range.

- We’ve lowered our oil price forecast for the end 2026 by US$5 to US$58 per barrel and project a further fall to US$55pb by the end of 2027 because we think the oil supply will increase. While we expect the net impact on global growth will be small, the changes will help to contain inflation. Weaker headline inflation will be good news for central banks, but we are sceptical that lower energy prices will push policymakers into reducing interest rates earlier or more aggressively.

Request a Free Trial

Complete the form below and we will contact you to set up your free trial. Please note that trials are only available for qualified users.

We are committed to protecting your right to privacy and ensuring the privacy and security of your personal information. We will not share your personal information with other individuals or organisations without your permission.

Find out how Oxford Economics can help you

Talk to us