Why a surge in US corporate defaults is unlikely

Surprisingly, the rate hiking cycle in the US has not been accompanied by a spike in financial distress. This partly reflects the delayed impact of monetary tightening, leading some commentators to argue stress indicators such as corporate default rates will surge this year.

What you will learn:

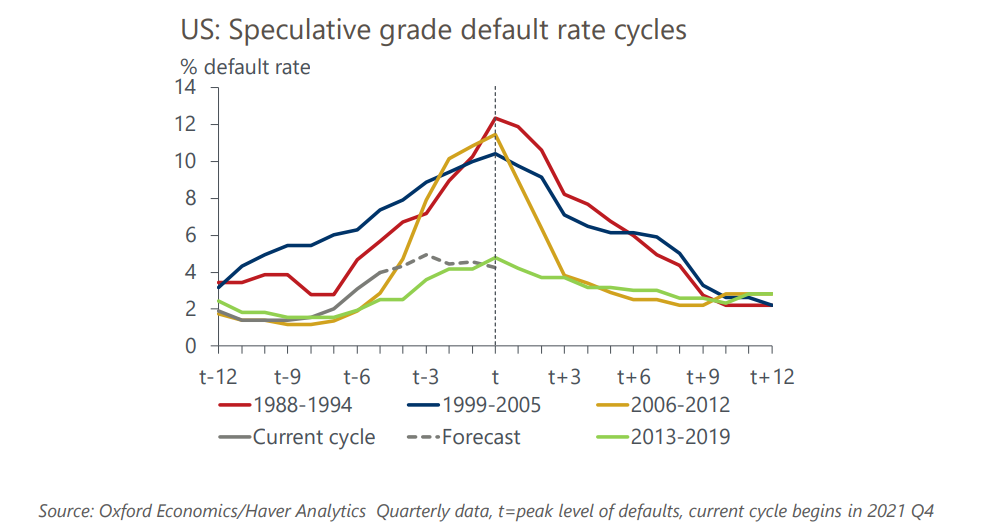

- But our modelling suggests this is unlikely unless the macroeconomic picture deteriorates dramatically. Despite the historically sharp rise in US interest rates, the increase in the US speculative default rate so far has been muted. The current rate of 4% is much lower than the peak 10%-12% levels seen in some previous default cycles.

- We modeled the US speculative default rate using industrial production growth, unemployment, interest rates and a proxy for the health of corporate balance sheets. Our model explains around 75% of the variation in default rates since 1989 Q3 and is a useful guide to where defaults are likely to go next.

- Using our baseline forecasts for the US economy, our model suggests only a modest further rise in the speculative default rate to around 4.9%. A mild recession could push the default rate to 5.8%. But even a hard landing featuring a peak 5% y/y drop in industrial output would only push up the default rate to around 7% according to our modelling.

Tags:

Related Services

Service

Emerging Markets Asset Manager Service

Emerging markets insight and opportunity at your fingertips.

Find Out More

Service

Global Asset Manager Service

A complete solution for asset managers who require convenient access to high quality, market-relevant analysis on key global markets.

Find Out More

Service

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More