New ECB framework a versatile toolkit for uncertain times

The European Central Bank’s updated monetary policy framework retains key advantages of the previous system and in our view is well-tailored to the eurozone’s bank-dominated financial infrastructure. It also gives the ECB a versatile toolkit allowing it to react flexibly to episodes of market stress.

What you will learn:

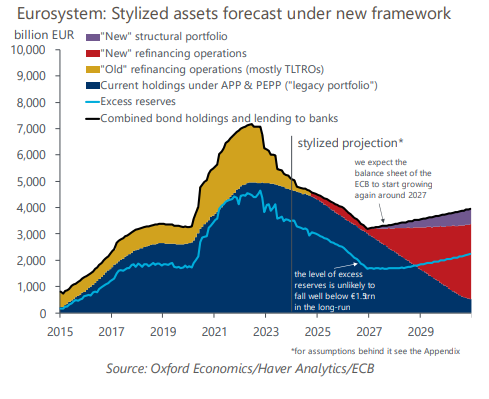

- An update to the way the ECB provides liquidity to the financial system was needed as its supply of reserves is being drawn down through quantitative tightening. In particular, the ECB needed to choose between the pre-crisis ‘corridor’ system in which reserves are scarce or stick to the current ‘floor’ system of ample reserves.

- The ECB opted for a demand-driven floor system, whereby banks will make use of a lending facility to ensure that reserve holdings match operational, liquidity and risk management needs. A key advantage of this system is that it limits volatility and prevents sudden spikes in market rates.

- In addition, the ECB’s decision to narrow the spread between the deposit and refinancing rates to 15bps implies a non-negligible “cost of carry” for banks and is meant to resuscitate a largely dormant interbank lending market.

- As a result of the changes, the supply of safe assets should be larger, making collateral shortages less of a risk. The ECB’s new structural portfolio will also allow the central bank to affect market conditions for public and private assets.

- The ECB decided to keep the minimum reserve requirement (MRR) at 1%. While this decision will postpone the return of the eurosystem to profitability, it was probably needed to avoid the hit to liquidity in vulnerable banking jurisdictions, particularly Italy’s.

Tags:

Related Posts

Post

Why we believe the industry cycle in the Eurozone is finally turning

Even though incoming hard data on eurozone industry is still downbeat, leading indicators suggest that we're at a turning point. We expect favourable cyclical and structural tailwinds will now take over, and industry output to accelerate through this year to 2% y/y growth by Q4.

Find Out More

Post

Eurozone: Stubborn services inflation should not delay rate cuts

A slower fall in services inflation will partially offset the relatively stronger disinflationary forces in goods prices. We do not think it will derail European Central Bank rate cuts this year, but the pass-through of strong wage growth from the tight labour market poses upside risks

Find Out More

Post

Eurozone: Monetary loosening will boost growth – but not until 2025

After the sharp falls in eurozone inflation recently, a series of rate cuts this year by the European Central Bank is now the consensus view. However, monetary policy transmission takes time and we don't think growth will receive much of a boost from monetary loosening until 2025, though there's potential for some upside surprises.

Find Out More