Research Briefing

| Feb 29, 2024

US Office real estate is the bad gift that keeps on giving

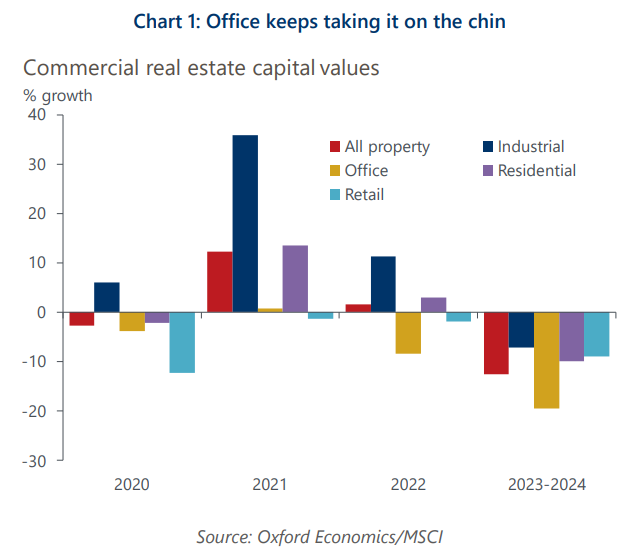

Our view remains that the most severe risks in commercial real estate are concentrated in the office sector, as it continues to deal with the pandemic-induced structural shift of increased remote and hybrid work.

What you will learn:

- In aggregate, commercial banks should be able to absorb losses on their portfolios because of lower CRE prices for offices. The risk is that the stress caused by CRE hits smaller banks, which have come under significant pressure.

- Today’s environment features flighty deposits, a high concentration of real estate loans among small institutions, and sizable property price declines. Odds are that the bank stress from offices is far from over because a significant number of loans are due this year and interest rates will decline more slowly than anticipated.

- The increased use of nonbanks as a source for credit has cushioned the blow to the economy from tighter lending standards among banks, but this poses a downside risk. Increased competition by nonbanks could put additional pressure on small regional banks to consolidate.

- Small banks are feeling the blunt of the stress in the office market. However, the regional economic implications also vary. Markets with a higher concentration of office properties are more likely to feel the effects from rising vacancy and falling values.

Tags:

Related Reports

Click here to subscribe to our real estate economics newsletter and get reports delivered directly to your mailbox

Demographics are set to propel niche property types in the UK

As the UK population ages, time-use data suggest that the property sectors with structural tailwinds will be those that provide space for activities related to home entertainment, eating and drinking, socialising, events, leisure, hobbies, and sports/exercise.

Read more: Demographics are set to propel niche property types in the UK

Amid disruption, what can US office learn from retail?

We examined the disruption of generative AI at the US county level. We identified several metros – Atlanta, Denver, New York, San Francisco, and Washington DC – that had at least one county with the highest percent of displaced workers from AI.

Read more: Amid disruption, what can US office learn from retail?

Global Private equity real estate fund maturities spur asset sales

We expect the significant increases in fund maturities, spurred by capital raised over the past decade, to exert upward pressure on the rate of asset disposals as the funds approach the end of their lifecycles.

Read more: Global Private equity real estate fund maturities spur asset sales

Real Estate Trends and Insights

Read more analysis on real estate performance and location decision-making.

Read more: Real Estate Trends and Insights