UK: Housing market on course for a soft landing

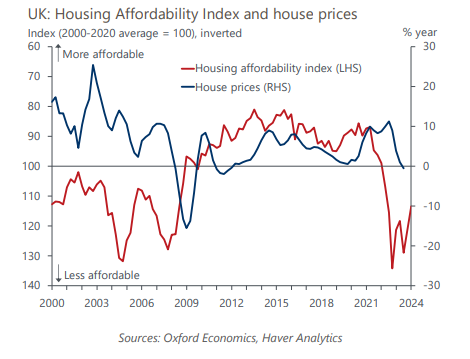

The recent sharp fall in mortgage rates and continued strong growth in wages has significantly reduced the scale of the UK’s housing affordability problem. Consequently, the risk of a steep correction in house prices is much lower than it appeared a few months ago. We also expect the recent steady pickup in housing market activity to continue.

What you will learn:

- Our Housing Affordability Index, which is based on the affordability of mortgage payments, suggests that house prices are currently 14% overvalued. This is down from 29% last summer.

- Though existing mortgagors needing to refinance this year still face a marked increase in debt servicing costs, the average uplift is now likely to be just under 200bps. Had mortgage rates stayed at their Q3 2023 levels, the average increase would have been 330bps.

- We now expect house prices to fall just 4% from peak-to-trough, a far smaller drop than in previous cycles. But such a shallow cycle would leave valuations still very stretched, limiting the scope for strong price growth in the recovery and keeping activity below historical norms.

Tags:

Related Posts

Post

Eurozone: Stubborn services inflation should not delay rate cuts

A slower fall in services inflation will partially offset the relatively stronger disinflationary forces in goods prices. We do not think it will derail European Central Bank rate cuts this year, but the pass-through of strong wage growth from the tight labour market poses upside risks

Find Out More

Post

Eurozone: Monetary loosening will boost growth – but not until 2025

After the sharp falls in eurozone inflation recently, a series of rate cuts this year by the European Central Bank is now the consensus view. However, monetary policy transmission takes time and we don't think growth will receive much of a boost from monetary loosening until 2025, though there's potential for some upside surprises.

Find Out More

Post

Weakness in construction and its related sectors show the impact of interest rate hikes

Ever since the onset of advanced economies’ campaign of interest rate hikes in December 2021 there has been a lively debate about the impact and efficacy of tighter monetary policy in terms of reducing inflation and slowing growth. While inflation has indeed fallen across the world, the relative economic resilience in the United States in particular, which has raised interest rates significantly more than the eurozone, has raised questions about if and how much interest rates are actually depressing activity.

Find Out More