The BoJ looks to buy time as pressures mount

The Bank of Japan maintained its monetary policy settings at today’s (18th Jan) meeting. At the same time, the BoJ decided to enhance the funds-supplying operations to put downward pressure in the belly zone of JGB yield. Meanwhile, revisions in inflation outlook were smaller than we had expected. We think that the BoJ will continue to stick to its current Yield Curve Control policy ahead. The BoJ will continue to intervene in the JGB market actively in the coming quarters, but a slowdown in inflation together with calming global yields should gradually alleviate upward pressures on the yield curve in H2 2023.

What you will learn:

- The Quarterly Outlook Report raised the median CPI (excluding fresh food and energy) forecast slightly to 1.8% from 1.6% for FY2023. However, the BoJ continues to view high inflation as transitory. The BoJ’s projection of a 1.6% rise in FY2024 is still short of its 2% target.

- We share the BoJ’s view that continued 2% inflation is unlikely due to a lack of sustained wage rises. We believe that weak demand means the recent high price pass-through from increased costs to final goods won’t be sustained. Also, signs of alleviation in import prices are emerging.

- That said, contrary to the BoJ’s intention, the disorderly functioning of the JGB market and a kink in the yield curve continue. To fight the upward pressure in the yield curve, the BoJ is conducting JGB purchases aggressively, absorbing most recently issued 10-year JGBs.

- If pressures on JGBs persist the BoJ could still be forced to widen the YCC corridor further, for instance by expanding it to +/-0.75% or +/-1.00%, to buy time. We think this risk is still high.

Tags:

Related Resouces

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More

Post

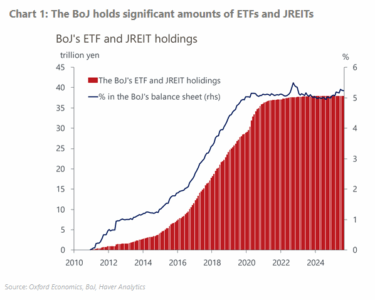

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More