Spillovers from a weaker China likely to be modest

China’s weak economy and the mounting problems of the real estate sector have focused attention once again on the potential global fallout from its sharply slower growth. To understand the consequences for the global and regional economies, we conducted a comprehensive simulation exercise using the Oxford Global Model.

What you will learn:

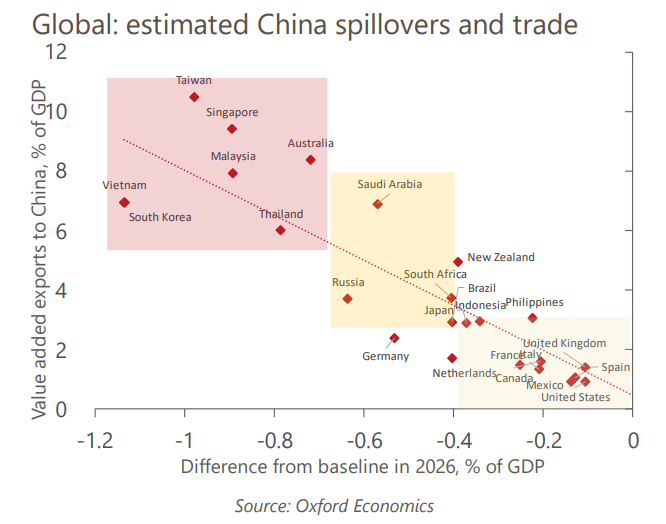

- Despite China’s large role in the world economy, we estimate the global spillovers from a severe slowdown would likely be moderate. Our modelling suggests that a 4% drop in Chinese GDP by 2026 relative to our baseline would cut G7 GDP by only 0.2%, though the impact on neighbouring Asian economies would be bigger.

- Our simulation assumes a short, sharp downturn emanating from the real estate sector. In addition, links between the financial and property sectors lead to compromised balance sheets and impaired capital allocation, which damage medium-term growth by 0.5ppts per year.

- In this scenario, the impact of a weaker China is mostly felt via real economy channels as its global financial links are relatively modest. The biggest hits are to economies with deep trade links to China, followed by exporters of China-sensitive commodities.

- We don’t assume any fiscal policy response in China in our scenario. But we estimate that fully offsetting the short-term downturn by fiscal measures would increase the general government debt-to-GDP ratio by 20ppts.

Tags:

Related Posts

Post

Japanification risk – down, but not out

Our updated analysis shows that the risk of 'Japanification' – a lengthy period of low growth and low inflation or deflation – has increased in Asian economies like China but declined in Europe. However, some of the changes may not be permanent. Economies are still settling down after the upheavals of the pandemic and some key underlying drivers of Japanification remain in place.

Find Out More

Post

Rapid ageing a tailwind for the aged care sector in Asia Pacific

We believe aged care is emerging as a prominent sector in Asia with a robust growth outlook.

Find Out More