Rate cuts are a boon for metals markets…eventually

Inflation has fallen sharply in advanced economies over the past year, and we expect central banks to start cutting interest rates in the coming months. Commodity prices have reacted bullishly to every dovish signal by central bankers. Metal prices have increased after previous monetary easing cycles and will likely do so again. We anticipate metal demand to improve, leading to a gentle rebound of metal prices such as copper and aluminium that will gain momentum throughout 2025.

What you will learn:

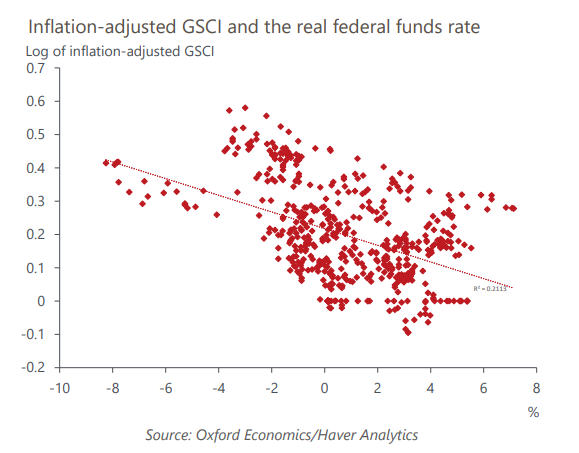

- While there are other fundamental drivers of commodity prices, reduced US interest rates will support prices through several channels, including increased demand, lower cost of carry and storage, and improved import purchasing power via favourable exchange rates against the US dollar. China is the largest importer of commodities, especially metals. A stronger yuan will lower the cost of its imports of US$-denominated commodities, boosting metal demand and prices.

- Metal-intensive sectors such as manufacturing and construction are especially sensitive to interest rates, so as they come down, commodity demand will begin improving in H2. Lower interest rates help reduce the cost of carrying and storing commodity-grade inventories, especially bulks like metals. With demand improving and interest rates falling, as well as other cost pressures, we anticipate an increase in cyclical metal restocking, which will support prices. Higher exchange inventories and liquidity will also help reduce price volatility.

- As markets dial back their expectations over the timing and align to our view of the Federal Reserve’s first rate cut in May, we think that gold prices will get closer to rallying. Strong central banks’ purchases, led by China, will continue to support prices, and add to the upward pressure from falling Treasury yields in H2.

Tags:

Related Services

Service

Industry and Product Market Forecasting

Oxford Economics helps you translate what the broader questions around key economic and sector trends, risk, technology disruptors, as well as policy and regulatory changes mean for your organisation. Our models and forecast datasets can be customised to fit your unique needs, helping you quantify key correlations for sales and market demand forecasting and more generally support your overall decision-making process.

Find Out More

Service

Global Industry Service

Gain insights into the impact of economic developments on industrial sectors.

Find Out More

Service

Commodity Price Forecasts

Monthly reports on commodity price trends and forecasts, as well as weekly briefings on the latest price action.

Find Out More