Research Briefing

| Mar 20, 2024

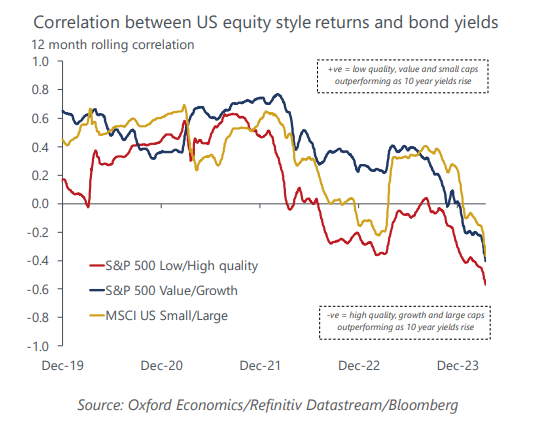

Quick Take – low quality stocks to benefit from a soft landing

We think lower quality stocks such as small caps will be the key beneficiaries of our soft-landing view. These stocks have been the most vulnerable to rising yields over the past year but are likely to fare better as the major central banks begin to cut rates around the middle of the year.

Tags:

Related Reports

Click here to subscribe to our asset management newsletter and get reports delivered directly to your mailbox

Trumponomics – the economics of a second Trump presidency | Beyond the Headlines

The 2024 US Presidential Election is less than seven months away. In this week’s Beyond the Headlines, Bernard Yaros, Lead Economist, outlines two scenarios for the US economy if former President Donald Trump returns to the White House and Republicans sweep Congress.

Read more: Trumponomics – the economics of a second Trump presidency | Beyond the Headlines

How Inflation eroded governments’ debts and why it matters | Beyond the Headlines

The supply-shocks era (2020-23) represented the first time in a generation where inflation significantly eroded the real value of global public debt. In this week’s video, Gabriel Sterne, Head of Global Emerging Markets, focuses on the extent to which governments seized that opportunity.

Read more: How Inflation eroded governments’ debts and why it matters | Beyond the Headlines

Economics for Asset Managers

Read more of our analysis and reports on asset management and economic outlook.

Read more: Economics for Asset Managers