Research Briefing

| Nov 14, 2023

Lower inflation will allow rates to fall faster in EA than US/UK

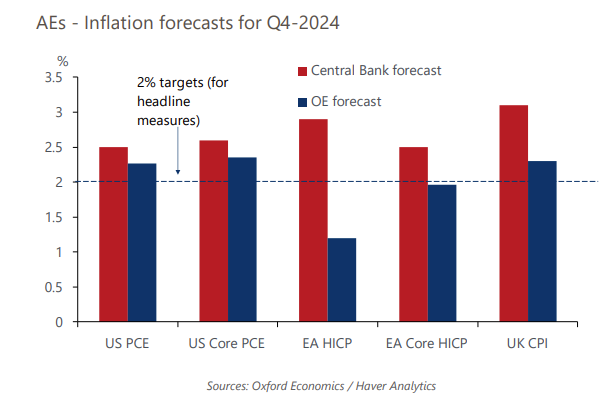

We expect widespread declines in inflation and interest rates in 2024 across advanced economies. A key differentiator, however, is that the eurozone is likely to see a faster return of inflation to target and a sharper fall in interest rates than the US and UK.

What you will learn:

- Aside from the common impact of global constraints on the supply of traded goods, the drivers of high inflation over the last couple of years have differed across advanced economies. This explains the divergence in inflation prospects.

- In the US, domestic supply-demand imbalances, notably in the labour market, have played a major role and are fading only slowly. Domestic imbalances have been smaller in the eurozone, with a bigger impact on headline and core inflation from higher energy and food prices, which is now unwinding quickly. The UK has suffered both channels, with a large impact from energy and food prices, which is now unwinding, but also a tight labour market and high pay growth.

- In the eurozone, the economy is close to recession and headline inflation is likely to fall back to 2% around mid-2024. We expect a rapid ECB easing cycle to begin about six months from now. The journey back to 2% inflation in the US is likely to be more protracted, and the Fed probably will need to see a further sustained easing of labour market conditions and pay growth before easing is on the agenda. We pencil in the first rate cut late next year.

Tags:

Related Services

Service

European Macro Service

A complete service to help executives track, analyse and react to macro events and future trends for the European region.

Find Out More

Service

UK Macro Service

Track, analyse, and react to macro events and future trends in the United Kingdom.

Find Out More