Japan’s on course for July rate hike, but risk of June increases

The Bank of Japan (BoJ) kept its policy rate at 0.50% at Wednesday’s meeting, as expected. Despite a marginally higher increase in pay than last year at the first round of the spring wage negotiations, our baseline view is for the BoJ to hike its policy rate only gradually due to concerns about the capacity of small firms to raise wages and the lacklustre rate of consumption.

What you will learn:

- We still expect the next hike will take place at July’s policy meeting, but the BoJ might move in June if wage agreements at small firms exceed expectations. Moreover, risks to the global outlook posed by the shift in US policy and the potential for political uncertainty around the upper house election in July are further motivations for a June hike.

- ”Trump 2.0′ poses various risks to the BoJ policy outlook: high tariffs on autos could have a material effect on growth; higher inflation and interest rates in the US could prompt a sharp fall in the yen and force the BoJ to hike faster; and US pressure on Japan to raise defence spending could increase the neutral rate and destabilise the Japanese government bond (JGB) market.

- We raised our inflation forecast this month to reflect the persistent supply-side inflation pressure on food, especially rice, but didn’t change our policy rate forecast. However, if inflation expectations rise, the BoJ’s terminal rate could turn out to be higher than our projection of 1%.

Tags:

Related Posts

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More

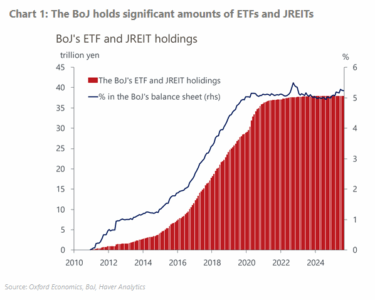

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More