Japan’s BoJ will start reducing JGB purchases in August

At Friday’s meeting, the Bank of Japan (BoJ) announced its decision to start reducing the volume of its JGB purchases by a substantial scale in August to ensure long-term rates are more market-oriented. At the next policy meeting on July 30th-31st, the bank will decide a detailed plan and schedule for the reduction covering the next two years after consulting with market participants.

What you will learn:

- As expected the BoJ decided to maintain its policy rate at 0%-0.1%. Wage growth looks set to remain robust based on the latest tally of the Spring Wage Negotiation, but household income and consumption are still weak and core-core CPI (excluding energy and fresh foods) eased further in April reflecting receding supply-side inflationary factors.

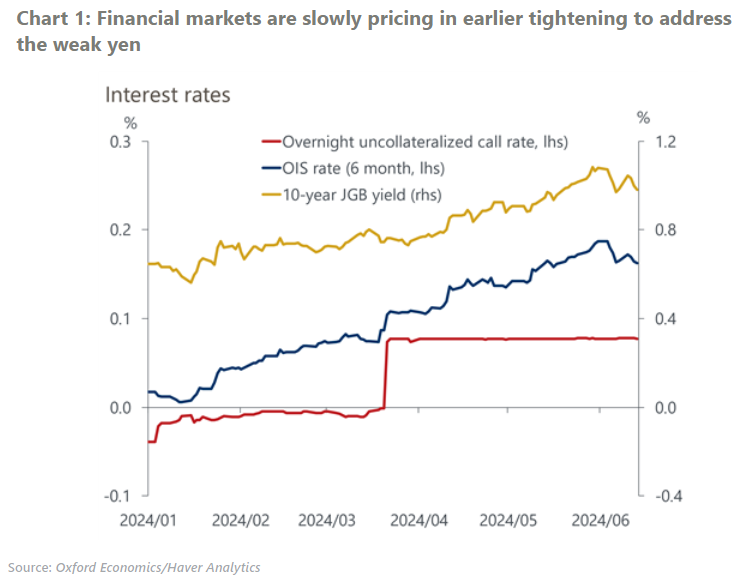

- Speculation over earlier tightening is rising in response to the weak yen. However, we believe the BoJ will wait until September to confirm that the strong wage settlement effectively raises real household incomes, and that consumption has gained momentum during the summer vacation.

- Despite recent hawkish statements by BoJ officials, we still think the yen weakness is unlikely to be a trigger for a rate hike. Most importantly, the BoJ’s rate hike will have only a limited impact on the currency which is dominated by the US monetary policy outlook.

Tags:

Related Posts

Post

Japan’s on course for July rate hike, but risk of June increases

The Bank of Japan (BoJ) kept its policy rate at 0.50% at Wednesday's meeting, as expected. Despite a marginally higher increase in pay than last year at the first round of the spring wage negotiations, our baseline view is for the BoJ to hike its policy rate only gradually due to concerns about the capacity of small firms to raise wages and the lacklustre rate of consumption.

Find Out More

Post

Japan’s supply-driven food inflation to persist longer than expected

We have revised our CPI forecast upwards for this year and next, due to more persistent supply side-driven food inflation, led by soaring prices of rice. Despite the significant revision to the short-term inflation path, we don't expect the Bank of Japan (BoJ) to react with a rate hike.

Find Out More

Post

Japan’s older households to support spending under higher rates

The resilience of consumption is essential to support sustained wage-driven inflation and the Bank of Japan's rate hikes. We see little risk of spending faltering due to the projected gradual rate hikes to 1% because the ageing of society has made households' balance sheets less vulnerable to rate increases.

Find Out More