Japan: The impact of structural labour shortages on inflation

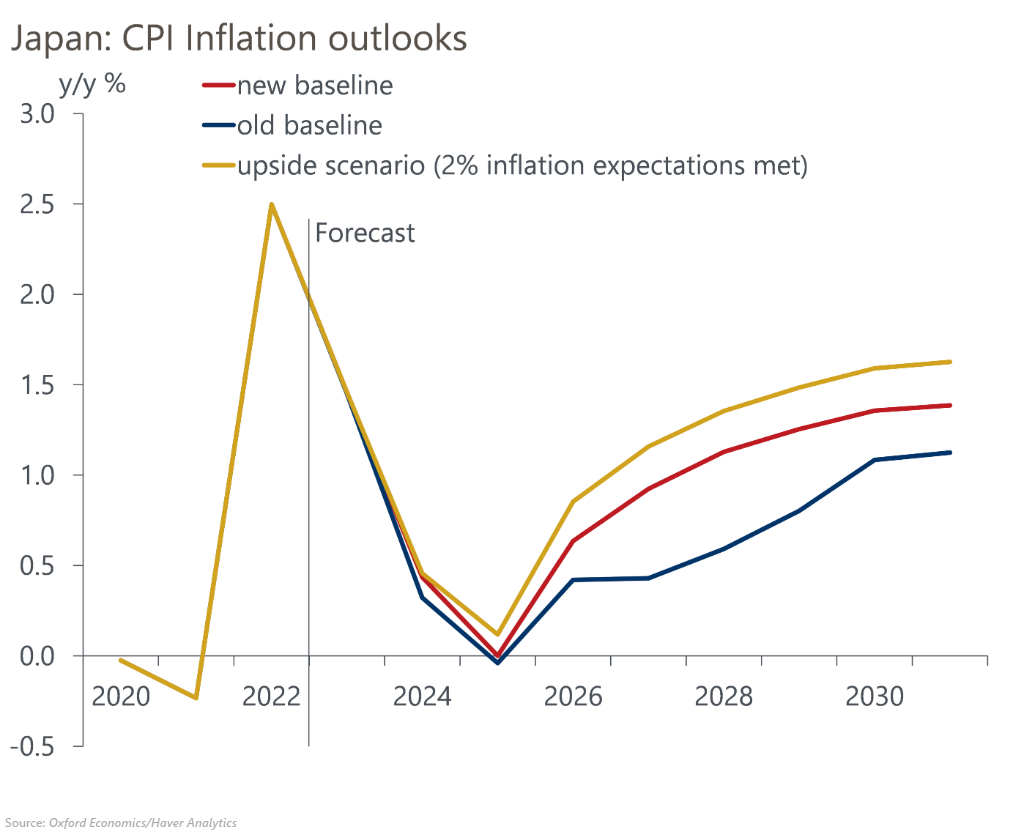

We have revised up our long-term wage and inflation projections based on a larger impact from structural labour shortages due to adverse demographic trends. Even after raising our wage growth assumptions by 0.5ppts on average over 2024-2030, however, we still forecast inflation only reaching 1.4% in 2030 – well short of the 2% target.

What you will learn:

- We now project higher base-wage increases for regular workers. We assume that wage growth set in the annual spring negotiations will rise gradually to 3% by 2030 from an average of 2.3% in the five years before the pandemic. Despite the rising need for wage increases to secure talented workers, Japan’s rigid employment system will constrain pay growth.

- We also revised up our projection for the hourly wage for part-time workers, which is more elastic to labour market conditions than wages for regular workers. We project hourly wages to increase as fast as in the late 2010s this year and then to accelerate, reaching close to 4% by 2030 due to the limited pool of additional labour supply.

- Gradual but persistent wage rises will boost inflation expectations accordingly. Given that Japan’s inflation expectations tend to be formed adaptively, we believe that inflation expectations will rise in accordance with actual price developments. In our baseline, we assume that inflation expectations will rise only gradually to 1.5% in 2030 from 1.1% in 2022.

Tags:

Related posts

Post

Japan’s fiscal policy will remain loose, which increases risks to debt sustainabilit

We've changed our fiscal outlook for Japan in our December forecast round. We now expect the new government to set a primary deficit close to that of 2024, at 2%-3% of GDP for 2025-2027, instead of restoring a balanced budget by taking advantage of strong tax revenue. We assume higher bond yields will force the government to take measures to reduce the deficit from 2028.

Find Out More

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More