Japan inflation to rise to 1.8%, but downside risks are high

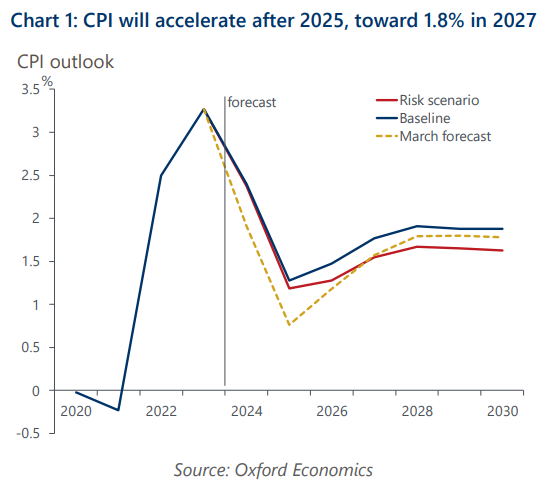

Reflecting a surprisingly strong Spring Negotiation result and weaker yen assumption, we have upgraded our baseline wage and inflation forecasts. We now project higher wage settlements will push inflation towards 1.8% by 2027. Uncertainty is high, however.

What you will learn:

- We anticipate the final outcome of the Spring Negotiation this year will likely be a wage rise of around 4.5% or more – much higher than last year’s 3.6%. We upgraded our wage projections for the next few years to reflect more aggressive wage-setting behaviour by top-tier firms.

- The main downside risk to our outlook is the sustainability of wage increases by SMEs. Another downside risk is disappointing demand growth, which will constrain pricing power.

- In our downside scenario, which assumes that these inter-related downside risks materialise, we project the CPI inflation rate would stabilise at 1.6% in 2027.

Tags:

Related Posts

Post

Japan’s fiscal policy will remain loose, which increases risks to debt sustainabilit

We've changed our fiscal outlook for Japan in our December forecast round. We now expect the new government to set a primary deficit close to that of 2024, at 2%-3% of GDP for 2025-2027, instead of restoring a balanced budget by taking advantage of strong tax revenue. We assume higher bond yields will force the government to take measures to reduce the deficit from 2028.

Find Out More

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More