Research Briefing

| Mar 4, 2024

Fundamentals favour London as a resi opportunity

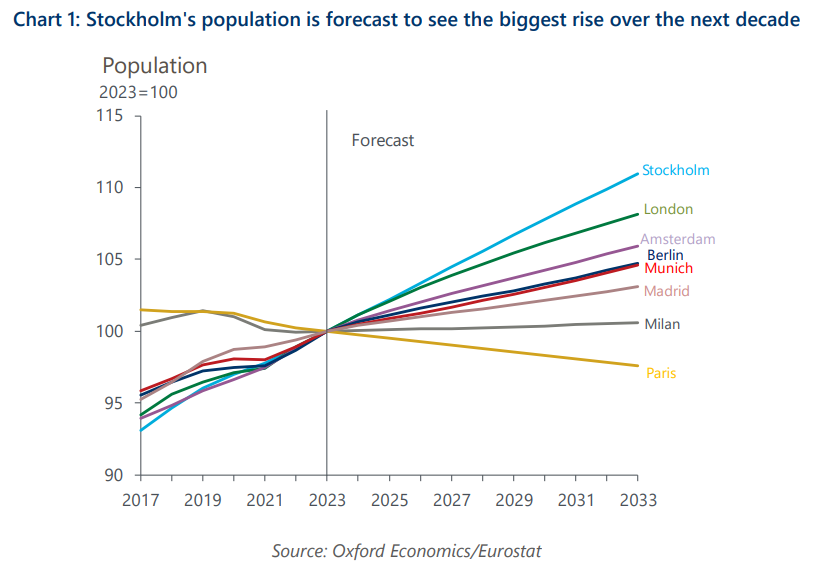

Among major European cities, we think London offers the best outlook for residential real estate based on demographic trends and supply constraints. Amsterdam and Madrid are also promising. Prospects for cities in France, Germany, and Italy are more mixed, with stretched affordability supporting rental demand, whereas demographic dynamics are relatively weak.

What you will learn:

- We forecast household numbers in Stockholm, Amsterdam and London will rise the most by the early 2030s. London also has a particularly high share of the population in the 20-34 age group, a key metric for rental demand.

- We also project Milan’s younger population will increase healthily over the next decade or so. Alongside Milan’s particularly expensive property prices relative to incomes, and supply constraints, this should support growth in rental demand.

- Berlin and Munich are both forecast to see weak growth in household formation and an outright fall in their 20-34-year-old populations. But in mitigation, the outlook for household income growth in the two German cities is comparatively strong.

Tags:

Related Reports

Click here to subscribe to our real estate economics newsletter and get reports delivered directly to your mailbox

Demographics are set to propel niche property types in the UK

As the UK population ages, time-use data suggest that the property sectors with structural tailwinds will be those that provide space for activities related to home entertainment, eating and drinking, socialising, events, leisure, hobbies, and sports/exercise.

Read more: Demographics are set to propel niche property types in the UK

Amid disruption, what can US office learn from retail?

We examined the disruption of generative AI at the US county level. We identified several metros – Atlanta, Denver, New York, San Francisco, and Washington DC – that had at least one county with the highest percent of displaced workers from AI.

Read more: Amid disruption, what can US office learn from retail?

Global Private equity real estate fund maturities spur asset sales

We expect the significant increases in fund maturities, spurred by capital raised over the past decade, to exert upward pressure on the rate of asset disposals as the funds approach the end of their lifecycles.

Read more: Global Private equity real estate fund maturities spur asset sales

Real Estate Trends and Insights

Read more analysis on real estate performance and location decision-making.

Read more: Real Estate Trends and Insights