Research Briefing

| Feb 27, 2024

Fixed Income: Kiwi bonds to fly high

We remain steadfast on our long-standing heavy overweight in New Zealand government bonds within our global DM fixed income allocations.

What you will learn:

- Upside surprises in activity and inflation this year have opened the market’s mind to the possibility of a hike in H1. But we doubt the criteria set out in the November monetary policy statement for a hike have been met.

- Our economists think the RBNZ will instead remain on hold in H1 before cutting twice in H2 as inflation falls to target and unemployment rises.

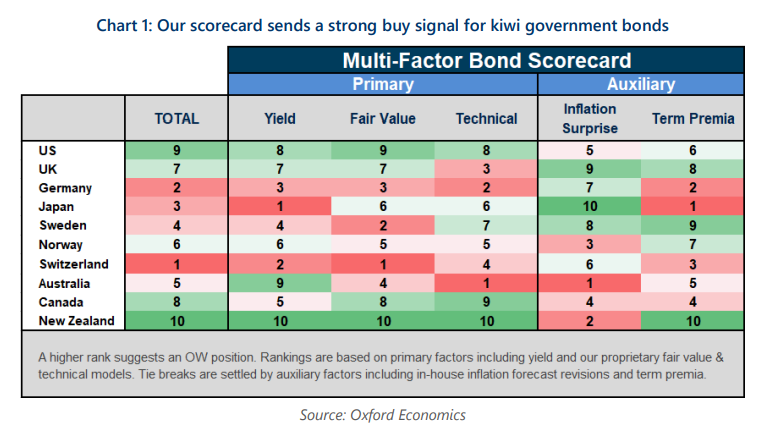

- Our multi-factor rates scorecard adds to our conviction, sending a near unanimous signal that kiwi bonds will outperform other developed market govies in the near term, based on attractive term premia, cheap valuations and strong mean-reverting properties.

Tags:

Related Reports

Click here to subscribe to our asset management newsletter and get reports delivered directly to your mailbox

Trumponomics – the economics of a second Trump presidency | Beyond the Headlines

The 2024 US Presidential Election is less than seven months away. In this week’s Beyond the Headlines, Bernard Yaros, Lead Economist, outlines two scenarios for the US economy if former President Donald Trump returns to the White House and Republicans sweep Congress.

Read more: Trumponomics – the economics of a second Trump presidency | Beyond the Headlines

How Inflation eroded governments’ debts and why it matters | Beyond the Headlines

The supply-shocks era (2020-23) represented the first time in a generation where inflation significantly eroded the real value of global public debt. In this week’s video, Gabriel Sterne, Head of Global Emerging Markets, focuses on the extent to which governments seized that opportunity.

Read more: How Inflation eroded governments’ debts and why it matters | Beyond the Headlines

Economics for Asset Managers

Read more of our analysis and reports on asset management and economic outlook.

Read more: Economics for Asset Managers