Research Briefing

| Apr 5, 2024

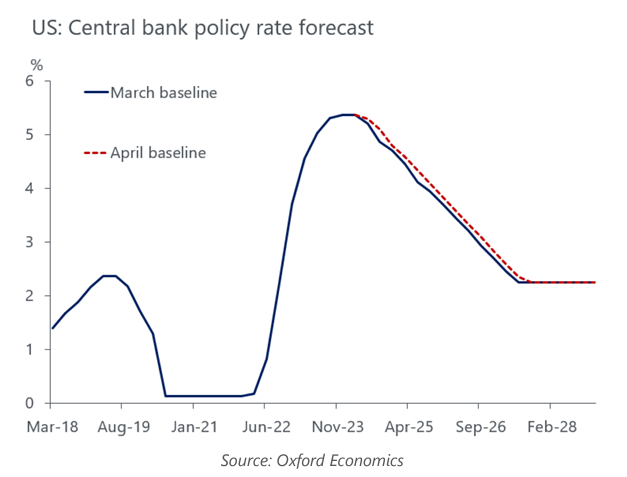

Fed forecast – Sorry, your delivery has been delayed

The strength of the labor market and lingering worries about inflation among Federal Reserve officials have led us to push the timing of the first rate cut from the May to June meeting of the Federal Open Market Committee.

What you will learn:

- Though this forecast change has minor implications for the broader economy, risks are rising that the Fed could wait longer and cut less this year than our new forecast. Our subjective odds that the first-rate cut will occur in either July or September are rising but are not high enough to have this as the most likely outcome. Our assessment is that most of the Fed members want to wait a little longer and are less concerned that past tightening in monetary policy will cut into the economy. This opens the door for the Fed to be patient.

- The March employment report reinforces our view that the strength of the supply side of the economy will help mitigate some of the upside risks to inflation from a strong trend in job growth. The Employment Cost Index for private workers, our preferred measure, is moderating and the drop in the quits rate suggests that nominal wage growth is moving closer to the 3.5% needed to be consistent with the Fed’s inflation target.

- The Fed has a bias toward cutting interest rates this year, but the strength of the labor market and recent gains in inflation are giving the central bank the wiggle room to be patient. If the Fed does not cut interest rates in June, then the window could be closed until September because there is little data released between the June and July meetings that could alter the Fed’s calculus. The odds are rising that the Fed cuts rates less than 75bps this year.

Tags:

Related Services

US Forecasting Service

Access to short- and long-term analysis, scenarios and forecasts for the US economy.

Find Out More

Macro and Regulatory Scenarios

Our models, forecasts, and datasets can be customised to fit the unique needs of your organisation.

Find Out More

Bespoke Business Forecasting

We are here to support your corporate planning and strategic decision making with customised solutions that are tailored to your requirements.

Find Out More