Eurozone: Stubborn services inflation should not delay rate cuts

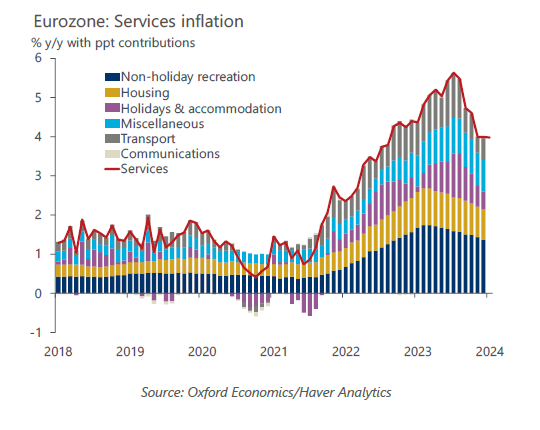

A slower fall in services inflation will partially offset the relatively stronger disinflationary forces in goods prices. We do not think it will derail European Central Bank rate cuts this year, but the pass-through of strong wage growth from the tight labour market poses upside risks.

What you will learn:

- Services are the stickiest inflation component as labour-intensive production makes for a delayed pass-through of wage growth. However, recent strong wage growth primarily reflects a temporary catch-up for real incomes as wages react to past inflation. Several measures of wage growth show pressures beginning to abate, and as inflation falls, wages should follow with a lag.

- Firms may pass on higher wages to prices rather than reduce their profit margins, but we think there is limited scope for this given still-subdued consumer spending. Selling price expectations have fallen and are stabilising across service sectors while medium-term inflation expectations are anchored, so a more permanent upward repricing should be avoided.

- Easing price pressures elsewhere should have downward spillover effects. Oil prices have risen year to date, but the sizeable fall last year benefitted the transport sector. Falling food inflation is easing restaurant prices. Red Sea trade disruption should only have a limited, indirect impact, but much uncertainty remains on how much this may derail the broader disinflationary process.

- If there is continued progress on wage growth moderation, headline inflation eases, and growth remains lacklustre, slow services disinflation should not stop the European Central Bank from cutting rates rapidly this year. But a larger-than-assumed spillover of Red Sea trade disruption could bolster more hawkish council members to argue for slower policy normalisation.

Tags:

Related Posts

Post

Eurozone: Monetary loosening will boost growth – but not until 2025

After the sharp falls in eurozone inflation recently, a series of rate cuts this year by the European Central Bank is now the consensus view. However, monetary policy transmission takes time and we don't think growth will receive much of a boost from monetary loosening until 2025, though there's potential for some upside surprises.

Find Out More

Post

Eurozone: Core goods disinflation should prompt rate cuts next spring

Weak demand, profit margin compression, easing pipeline pressures, and abating supply bottlenecks mean we see core goods inflation strongly coming down in 2024, supporting our below-consensus inflation forecast.

Find Out More

Post

Weakness in construction and its related sectors show the impact of interest rate hikes

Ever since the onset of advanced economies’ campaign of interest rate hikes in December 2021 there has been a lively debate about the impact and efficacy of tighter monetary policy in terms of reducing inflation and slowing growth. While inflation has indeed fallen across the world, the relative economic resilience in the United States in particular, which has raised interest rates significantly more than the eurozone, has raised questions about if and how much interest rates are actually depressing activity.

Find Out More