Eurozone: How shipping disruption is affecting inflation and rate cuts

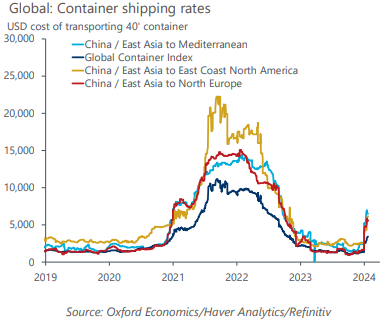

Disruption to shipping through the Red Sea now looks likely to keep transport costs elevated at least for the next few months. We estimate this will result in a peak lift of 0.3ppts to eurozone headline and 0.4ppts to core inflation in 2024, with the brunt of the impact coming in H2.

What you will learn:

- We assume that firms will pass on most of the increased costs to consumer prices, but weak demand and high inventories while profit margins are still elevated could limit the rise. For now, we don’t expect the disruption to lead to supply bottlenecks. But memories of the severe supply chain issues through the pandemic may bolster logistics firms’ pricing power, and if bottlenecks emerge, this could amplify the shock along the supply chain and the impact to consumer prices.

- We expect the lift to our headline inflation forecast will be mostly offset by a further drop in gas prices, which could be a around 15% lower in 2024 than we had assumed previously. This equates to a 0.2ppts cut to headline inflation. Crucially though, given the ECBs current focus, we think the passthrough of soaring shipping costs will keep core inflation above 2% in H2 2024.

- Given this expected rise in core inflation, we are likely to postpone our forecast for a first rate cut by the ECB to June from April, but we will make a final decision on this after the key January inflation release. We still anticipate total cuts of 125bps in 2024 as our baseline assumes headline inflation will fall below 2% in 2024. It’s also possible the ECB could still start to lower rates in April, followed by a more cautious pace of cuts at every other meeting.

Tags:

Related Services

Service

European Macro Service

A complete service to help executives track, analyse and react to macro events and future trends for the European region.

Find Out More

Post

Eurozone: Core goods disinflation should prompt rate cuts next spring

Weak demand, profit margin compression, easing pipeline pressures, and abating supply bottlenecks mean we see core goods inflation strongly coming down in 2024, supporting our below-consensus inflation forecast.

Find Out More

Post

Red Sea shipping attacks add to inflation risks

We assume the disruption to shipping caused by maritime attacks on commercial vessels in the Red Sea will be relatively short-lived and the recent spike in sea freight prices will reverse. While there will be near-term impacts for some firms and sectors, these won’t be enough to shift our baseline economic or inflation forecasts to any meaningful extent.

Find Out More