Easing financial conditions offer CRE some respite

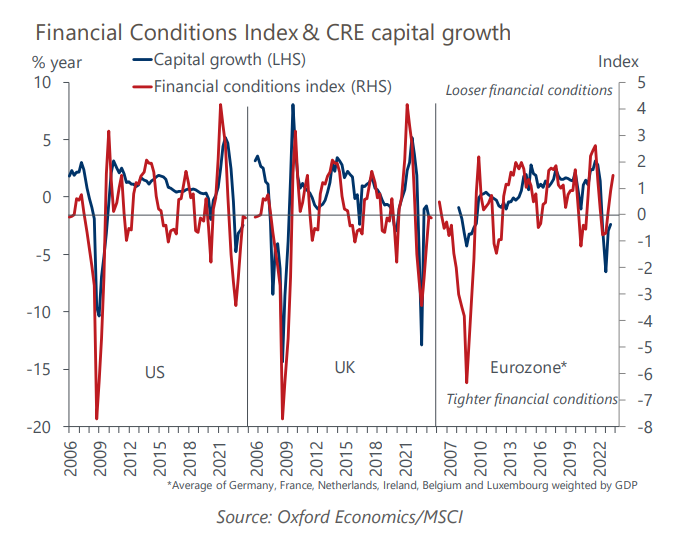

Our measure of financial conditions has become less restrictive in the US and started to loosen in the eurozone and the UK, reflecting investors’ expectations that interest rates have peaked. This should aid the outlook for commercial real estate (CRE) on the margins, although the scale of past rate hikes, sluggish economies, and structural headwinds mean the sector still confronts challenging fundamentals.

What you will learn:

- The evidence suggests that movements in financial conditions are an important driver of CRE prices, reflecting the sector’s use of bank lending and, indirectly, the influence of financial conditions on economic activity and demand for commercial property.

- The next move in interest rates by the Fed, the European Central Bank, and the Bank of England will likely be down, a particular positive for CRE given the importance of floating-rate debt and the scale of refinancing needs over the next few years. Among major economies, our measure of financial conditions has loosened the most in the eurozone, suggesting CRE upside for the bloc.

- However, CRE is confronted with pressures unrelated to financial variables, such as higher labour and material costs and, in the office sector, structurally lower occupancy rates. Hence, recent favourable moves in financial conditions will go only so far in supporting the asset class.

Tags:

Related Services

Post

Housing affordability lowest in Greek, Danish, and German cities

House prices across Europe have soared over the past decade, especially in cities. During this time, incomes in Europe have not kept pace with house price hikes on average, squeezing the purchasing power of homebuyers in many European cities.

Find Out More

Post

Office employment in cities is resilient, but risks remain

Oxford Economics set the stage for the year ahead, at our second Global Economic Outlook Conference, in London on Wednesday, 5 February.

Find Out More

Post

Steady, Yet Slow: How Oxford Economics Sees Global Economic Growth in 2025

Oxford Economics set the stage for the year ahead, at our second Global Economic Outlook Conference, in London on Wednesday, 5 February.

Find Out More