Chip upcycle is a bright spot, albeit still a dim one

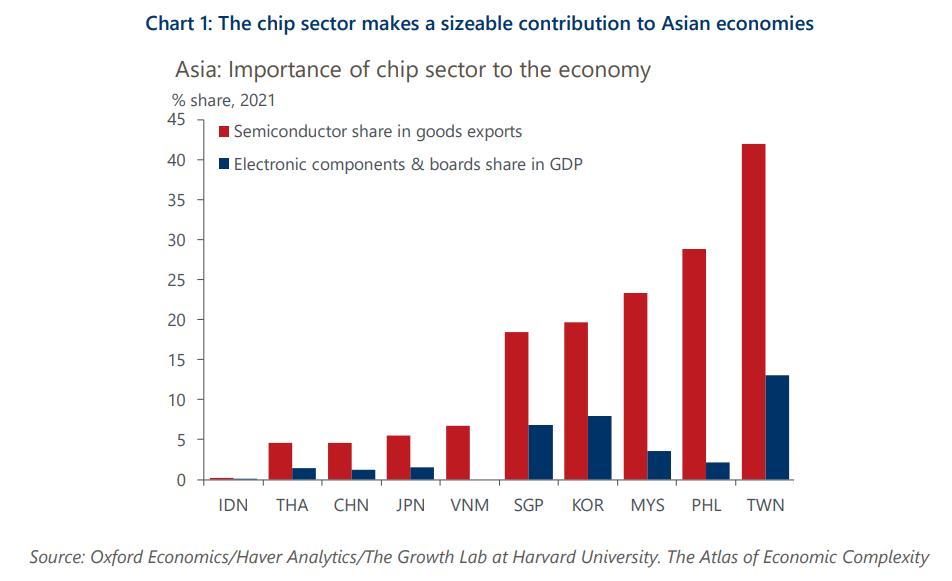

The chip sector is profoundly important for some Asian economies, given their role in the global semiconductor supply chain. As such, the ongoing recovery, albeit gradual, will provide some support to these economies amid the slowing global economy and tight domestic monetary policies.

What you will learn:

- Asia’s deeply integrated chip supply chain means the ongoing recovery in the sector will benefit the regional players evenly. The replacement demand for goods purchased during the pandemic will benefit memory and logic chips, as well as more diffuse chips that have a wider application.

- After turning earlier this year, we expect the chip-cycle upturn to be gradual. This is partly structural as chip cycles are rarely symmetrical, but there are additional headwinds this time.

- The slowing global economy will likely mute the replacement demand for goods, while accumulated inventory caused by the hoarding of chips during Covid will keep production relatively low. The normalisation in the automotive sector adds another obstacle.

- Although we think Asia’s position as the world’s chip-production hub will be little challenged for the foreseeable future, geopolitical conflicts and inward-looking policies are a risk.

Tags:

Related Posts

Post

Infographic: Measuring risk exposure to China-Taiwan tensions

We have developed a globally consistent framework showing cross-country GDP vulnerabilities to an escalation in China-Taiwan tensions, factoring in three key channels of risks: trade exposure to Taiwan and mainland China, wider economic and industry reliance on semiconductors for producing output and price ramifications of shortages and disrupted shipping.

Find Out More

Post

Measuring cross-country exposure to China-Taiwan tensions

Contingency planning for possible disruptions caused by rising geopolitical tensions is becoming an increasingly important factor in business strategy planning. To this end, we have developed a globally consistent framework showing cross-country GDP vulnerabilities to an escalation in China-Taiwan tensions, focused on disruption to the global semiconductor supply chain.

Find Out More

Post

ASEAN: How to climb the semiconductor value chain

The rise of AI promises vast business opportunities and growth potential for the semiconductor industry. But these benefits are not evenly distributed along the value chain, so for ASEAN economies, where semiconductor activities are focused on lower value-added segments such as assembly-testing-packaging, the benefits are likely to be limited.

Find Out More