China Key themes 2024 – A slower, but healthier, dragon year

China heads into 2024 with relatively loose policy settings, but private sector sentiment constrained by property pessimism. Policy efforts will reduce left tail risks but we don’t expect it will be sufficient to prevent the growth downtrend persisting. Recognizing an upside risk that authorities could instead stimulate their way to a high growth target in 2024.

This research report expands on these key themes:

- The economy will muddle through a tightly managed, multi-year clean-up process. The old ‘presales’ commodity housing model is no more. Transitioning to a new model that boosts the role of state-directed public and social housing could prompt further consolidation among onshore property developers. There may be bouts of credit stress, but they’re unlikely to be systemic.

- China is no longer the spender of last resort for the global economy, so don’t expect robust reflation. Accelerating efforts to resolve local government debt issues will put increasing onus on centrally funded tools for countercyclical policies, while top-down pressure to deliver on growth in 2024 will likely be less acute. A more disciplined approach to capital allocation will drive only a small uptick in the overall fiscal impulse. Inflation should stage an unspectacular ascent as supply-side disinflationary pressures fade.

- The investment recovery will be very sector-specific. The persistence of domestic regulatory uncertainties will temper the investment recovery, excluding property, in 2024. Sectors that benefit from policy tailwinds, plus high value-added manufacturing such as consumer electronics and autos, are likely to outperform.

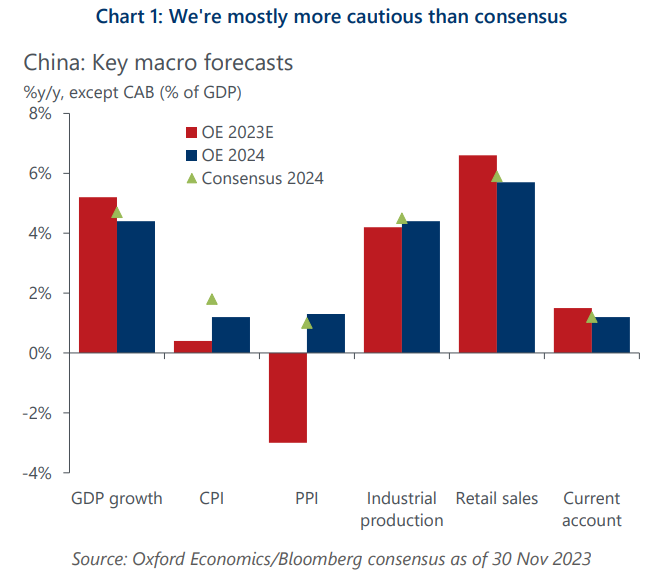

- Our 2024 forecast is: GDP growth to decelerate to 4.4% (consensus, 4.6%); inflation at 1.2% (consensus, 1.7%); nominal total social financing growth at 9.7% (down from 9.9%). With domestic fundamentals stabilising and narrowing rate differentials with the US, the USD/CNY should strengthen towards the 7.0-band by end-2024.

Tags:

Related Posts

Post

Infographic: key themes driving location decisioning in 2024

In this infographic, we present the themes that are crucial to location decisioning in 2024 and pinpoint potential bright spots.

Find Out More

Post

Dealing with the inflation hangover | Conference Presentation

In this presentation deck, Innes McFee, Chief Global Economist, explains how the outlook for the year is cautiously optimistic. Over the last year, inflation has come down as we expected with the economy holding up relatively better in the second half of the year.

Find Out More

Post

A mid-year transition from recession to recovery | Canada Up Close

The Canadian economy will begin 2024 still mired in recession as the lagged impact of higher interest rates continues to filter through. In our first Canada Up Close video, Tony Stillo, Director of Canada Economics, examines four key themes that will shape the economy’s performance in 2024.

Find Out More