Canada Key themes 2024 − A mid-year shift from recession to growth

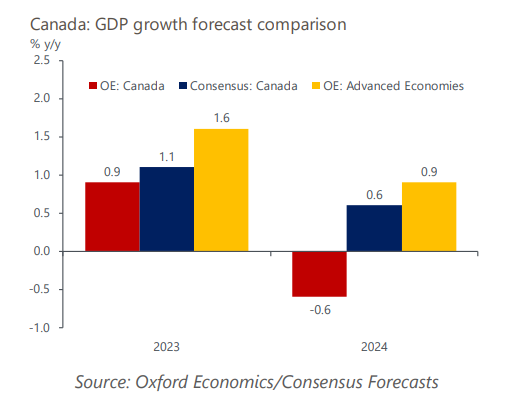

The Canadian economy will begin 2024 still mired in recession as the lagged impact of higher interest rates continues to filter through. However, we expect a modest recovery in the latter half of 2024 as the Bank of Canada begins to cut interest rates, disinflation continues, and global growth improves. Four key themes will shape the economy’s performance in 2024, which we expect will be well below the consensus view and worse than other advanced economies.

This research report expands on these key themes:

- A moderate recession will be followed by a muted recovery. Economic activity will continue to contract through mid-year, as soaring debt service costs from mounting mortgage renewals push indebted households to deleverage and unaffordability extends the housing correction. Consumers and businesses will gradually regain the willingness and ability to spend in H2 2024, but they will likely remain on edge as interest rates only slowly ease amid ongoing uncertainty.

- The migration-led population boom will continue. Another influx of immigrants and temporary residents in 2024 will continue to loosen the labour market, but also further strain the housing supply, particularly rentals, and pressure public services like health and social services. Canada’s population boom will lift the economy over time, as newcomers fully settle.

- The Bank of Canada will begin an easing cycle, as inflation returns to target. Growing slack in the economy alongside weaker global oil and food prices will bring inflation back to the 2% target by late 2024. We think ample evidence of this disinflationary trend will prompt the Bank to start cutting rates by mid-2024, albeit only gradually to avoid a potential course reversal later.

- Fiscal policy will be caught between a rock and a hard place. Barring a more severe economic downturn, the government will refrain from inflation-inducing fiscal stimulus that would undermine monetary policy. Instead, only targeted measures are likely as the moderate recession and fragile recovery play out, especially with a 2025 federal election on the horizon.

- Wildcards to watch out for in 2024 include a repeat of Canada’s wildfires, extreme weather, labour strikes, and supply disruptions. Externally, slowing US and world growth, amid festering global tensions and conflicts, add downside risk and considerable uncertainty.

Tags:

Related Services

Service

Canada Macro Service

Comprehensive coverage of the Canadian economy, providing clients with all of the information they need to assess the impact of developments in the economy on their business.

Find Out More

Service

Canadian Province and Metro Service

Data and forecasts for Canadian provinces and metropolitan areas.

Find Out More

Service

Canada Provincial Territorial Model

A rigorous and comprehensive framework to develop forecasts, scenarios and impact analysis at the national, provincial and territorial levels.

Find Out More