Asia Weekly Briefing: Lunar New Year adds noise and BNM likely to stay on hold

The first central bank in the region to pause rate hikes this year, Bank Negara Malaysia (BNM), is likely to remain on hold this Thursday. And in Japan, the Bank of Japan (BoJ) is likely to maintain its stance on Friday.

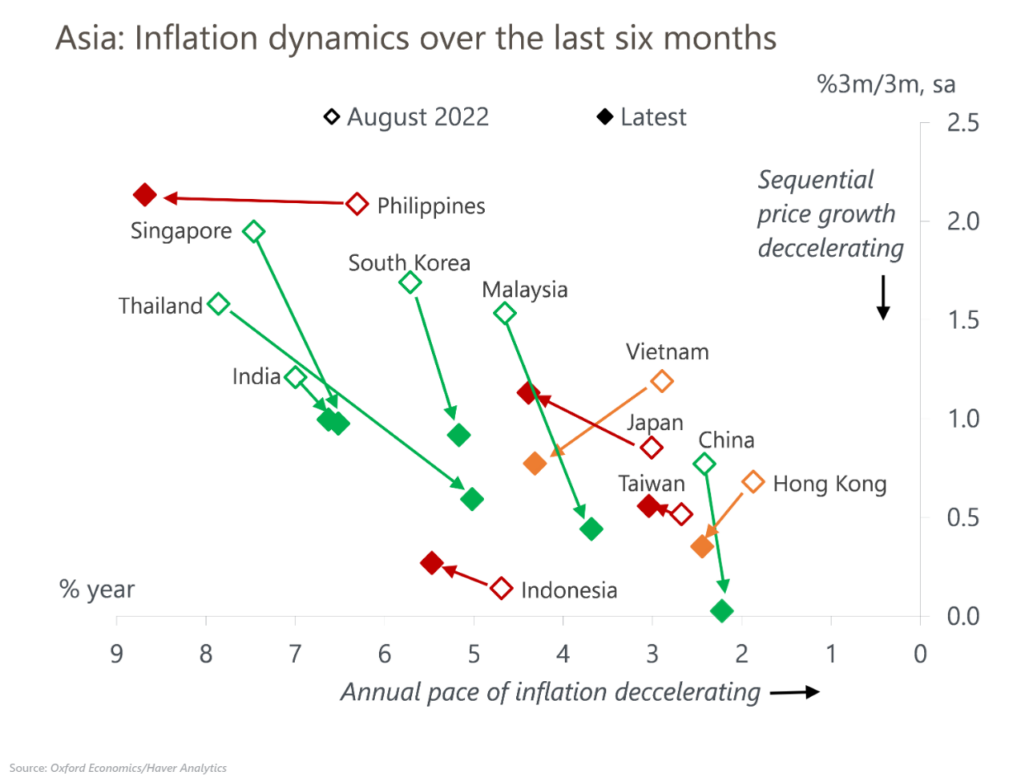

Inflation is likely to soften further in the coming months, following an easing of price pressures in the last third of 2022. But we may not see much sign of it in the February CPI data next week.

Easing pressure from inflation is likely to enable monetary policymakers to focus more on the increasingly downbeat growth outlook. We expect other central banks that have stopped hiking in recent weeks (South Korea and Indonesia) to also remain on hold throughout 2023.

The main risk to our view is if external pressures from monetary tightening in the US re-intensify. We now expect the Fed to hike three more times this cycle, by 25bps in March, May, and June.

Aside from Malaysia’s BNM meeting and a host of CPI data this week, the closely-watched “Two Sessions” political event will be held in China, trade data from China and Taiwan will be released, and Governor Haruhiko Kuroda will chair his last BoJ meeting.

Tags:

Related Resouces

Post

Trump tariffs to shake up Asian manufacturing in 2025

The new US tariffs add an additional layer of drag on Asian manufacturing activities. India will be one of the least affected countries.

Find Out More

Post

The risks to Asia from Trump’s tariff plans so far

We think the immediate tariffs on China will have spillovers to some other Asian economies, while the threat of reciprocal tariffs has raised the odds that of the rest of Asia will also be slapped with higher tariffs.

Find Out More