Research Briefing

| Nov 8, 2024

Asia maintains fiscal consolidation, but debt to fall slowly

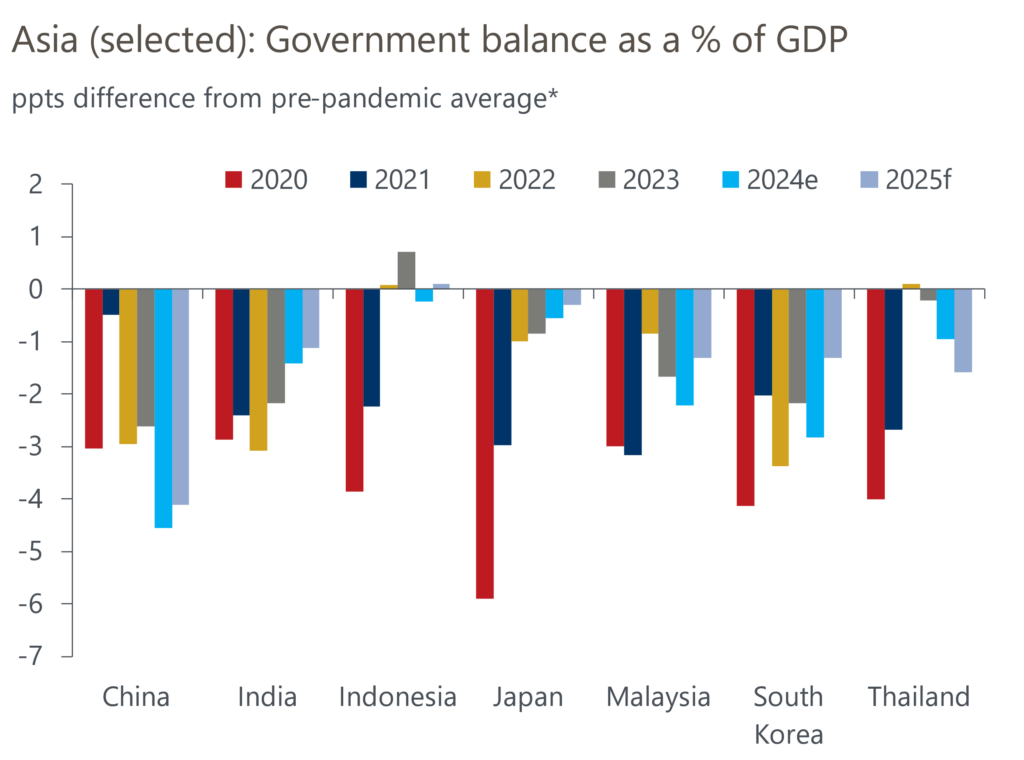

Recently, Asian economies have looked to consolidate their fiscal balances as the need for counter-cyclical policy reduces. After quickly raising public debt ratios during the pandemic years, inflation has normalised, and growth has started to return. Despite that, public debt ratios have yet to normalise; government balances as a percentage of GDP remain lower relative to pre-pandemic norms.

What you will learn:

- Asia’s post-pandemic progress on fiscal consolidation will likely be slow, given that revenues aren’t likely to surge nor expenditures cut significantly. That said, we see little reason to fret about public debt ratios.

- At the same time, we don’t think government expenditures will be cut significantly. Most pandemic-related support has already stopped, and with GDP next year expected to settle to low trend growth, it’s not likely that governments will be keen on major cuts to spending.

- We expect public debt-to-GDP ratios to move downwards from the 2025, with two exceptions: China and Hong Kong. Despite the measured pace of consolidation, we also think that sovereign debt repayments in Asia will generally go smoothly. We don’t think risks from deviations in exchange rates or interest rate paths from our baseline will be much of a concern.

Tags: