APAC Key themes 2024 – A year of living cautiously

In 2024, the main influence on Asia is likely to be a global slowdown, particularly in China and the US. Moreover, governments have limited policy space to deal with these headwinds. Other negative influences, however, are set to ease further, including domestic inflation, external pressure on interest rates, and softening semiconductor prices. Overall, we expect a bumpy year as issues become more country-specific and policy responses and economic outcomes diverge.

This research report expands on these key themes:

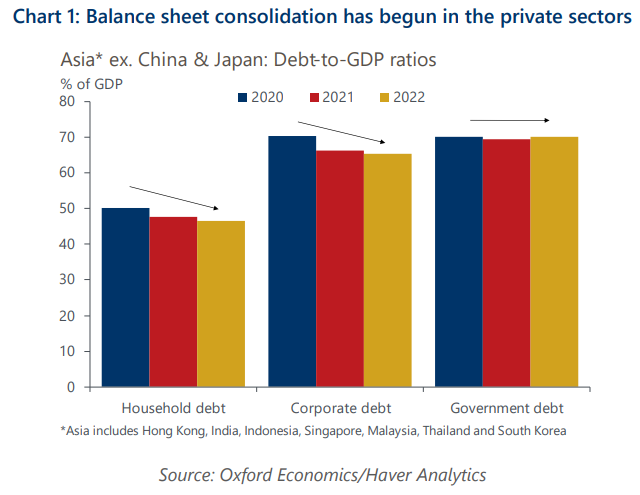

- Growth will be hard to find as the focus shifts to balance sheet repair. The external influences on Asia are changing and some negative influences finally seem to be abating. This is likely to be the year of balance sheet consolidation for both the government and the private sector.

- The disconnect between current accounts, exchange rates, and interest rates should normalise. As external pressures become less influential in 2024, we expect a return to some standard relationships: as growth slows, rates soften, as do currencies.

- China’s growth bounce is cyclical, but its problems are structural. The Chinese economy appears to have been hit particularly badly by Covid, but there has been a modest bounce back recently: Q3 growth was 1.3% q/q sa after growing by 0.8% in Q2. However, we think the bounce will likely be temporary.

- India’s surge is everywhere, and sentiment is bullish. India is likely to be the fastest growing G-20 economy in 2023 and 2024. There is much to cheer but also much to be done, especially on governance, health, and the environment.

Tags:

Related Posts

Post

Infographic: key themes driving location decisioning in 2024

In this infographic, we present the themes that are crucial to location decisioning in 2024 and pinpoint potential bright spots.

Find Out More

Post

Dealing with the inflation hangover | Conference Presentation

In this presentation deck, Innes McFee, Chief Global Economist, explains how the outlook for the year is cautiously optimistic. Over the last year, inflation has come down as we expected with the economy holding up relatively better in the second half of the year.

Find Out More

Post

A mid-year transition from recession to recovery | Canada Up Close

The Canadian economy will begin 2024 still mired in recession as the lagged impact of higher interest rates continues to filter through. In our first Canada Up Close video, Tony Stillo, Director of Canada Economics, examines four key themes that will shape the economy’s performance in 2024.

Find Out More