Japanification risk – down, but not out

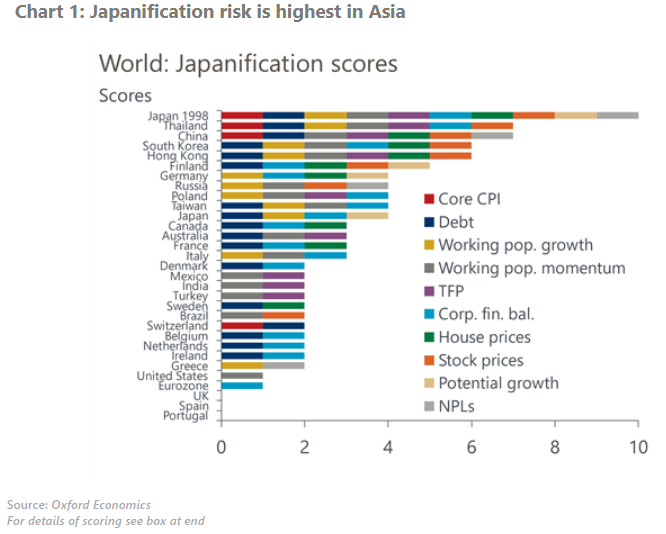

Our updated analysis shows that the risk of ‘Japanification’ – a lengthy period of low growth and low inflation or deflation – has increased in Asian economies like China but declined in Europe. However, some of the changes may not be permanent. Economies are still settling down after the upheavals of the pandemic and some key underlying drivers of Japanification remain in place.

What you will learn:

- European risk of Japanification has declined due to a mixture of factors. Stimulatory fiscal and monetary policies during the pandemic broke the deflationary cycle, short-run trends in working population growth have improved, and bank and private sector balance sheets are healthier. But there are some exceptions to this pattern, most notably Germany, where Japanification risk is up.

- On the other hand, China’s risk of Japanification has increased due to a large and ongoing property sector decline, policies encouraging excess supply, and very low inflation rates. Symptoms of a balance sheet recession, like that seen in Japan in the 1990s and 2000s, are becoming visible. Other parts of Asia, such as Thailand, are showing similar trends.

- A key factor that could contribute to rising Japanification risk in the years ahead is demographics, especially for Asia. Unlike some other observers, we do not view ageing societies as an inflationary factor. In addition, weak potential output growth and continued excess corporate savings could raise Japanification risk.

- Overall, our measure of Japanification risk has declined across economies on average since 2019. However, this has arguably occurred mostly due to luck than design and has relied in part on the short-term impact of the aggressive stimulus policies of 2020-2021. A return to more restrictive policy settings in areas like Europe could cause the reversal of the recent improvement in Japanification risk.

Tags:

Related Posts

Post

The economics of data sovereignty and data localisation mandates

As governments across Asia race to build digital economies, the question of where data lives has become one of the region’s most economically consequential policy debates.

Find Out More

Post

Navigating Tax Policy: How Economics Gives International Businesses Strategic Advantage in Asia

In Asia’s fast-changing economic and regulatory environment, tax policy is no longer just a matter for finance and legal departments—it’s a boardroom issue.

Find Out More

Post

New Rules of Engagement: The Strategic Rise of Government Affairs in Asia

What’s behind Asia’s new era of policy assertiveness? What does it mean for international firms?

Find Out More