Japan’s political calendar and yen will delay a rate hike to December

The Bank of Japan maintained its policy rate at 0.25% during Friday’s meeting. Although we still expect an additional rate hike this year, we now expect that it will take place in December rather than October, given the updated political calendar and the recent yen strength.

What you will learn:

- Economic developments seem to support an earlier rate hike. Though the CPI inflation is trending down, it is mostly due to a fading supply side pressures and will not likely alter the BoJ’s projection that its inflation target will be achieved in the coming years. Consumption is staring to improve as inflation eases and wages increase after a strong Spring Negotiation.

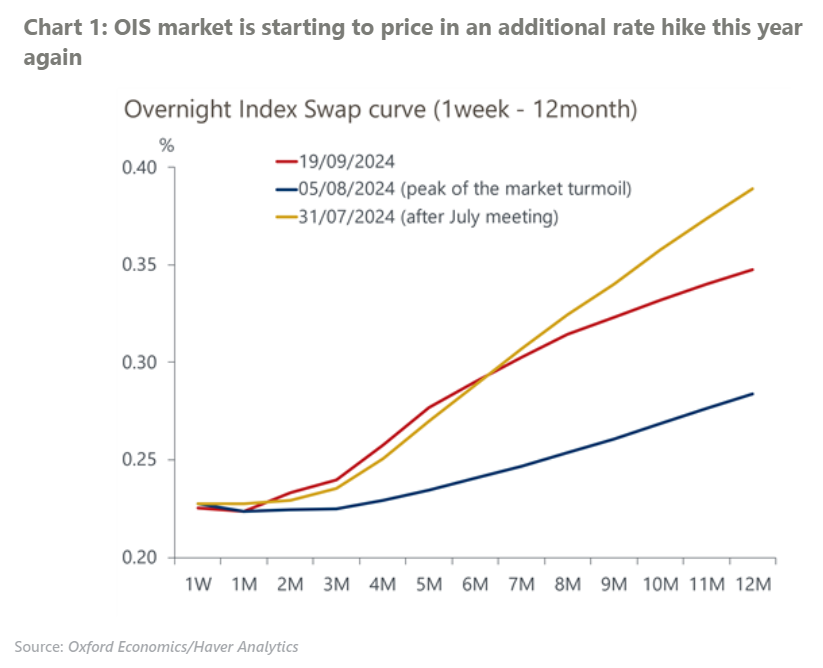

- Financial markets are still jittery but are gradually calming down following a period of heightened volatility in early August. As financial markets calm down, the bond market is again pricing in an additional rate hike by the BoJ within this year, backed by recent hawkish comments from BoJ officials.

- We now think that the BoJ’s next rate hike will be in December, rather than October, to avoid worsening its relationship with the new administration. Although the overall impact of an additional hike will be limited, its impact on vulnerable firms and households will not be politically welcomed. At the press conference, Governor Kazuo Ueda stated that recent yen gains have reduced upside risks to the price outlook and provided more time to consider next move.

Tags:

Related Posts

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More

Post

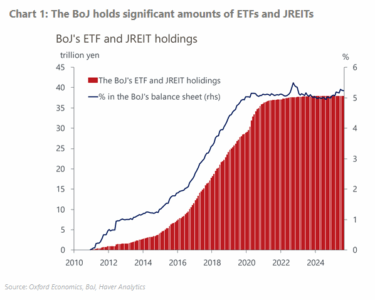

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More