Japan’s BoJ is now likely to front-load policy normalisation

We now expect the Bank of Japan will implement an additional rate hike this year, possibly in October, given the hawkish forward guidance at the July meeting. We previously projected the central bank would wait until next spring to hike again. Thereafter, we expect the BoJ to become more cautious and raise rates only once per year in 2025 and 2026 to reach a terminal rate of 1%.

What you will learn:

- The BoJ’s July policy statement said that the central bank will continue to normalise its policy rate as long as the economy stays on track with their projections. The BoJ emphasised that real interest rates are still significantly low and the policy rate will not likely reach the estimated range of a neutral rate anytime soon.

- We project the front-loaded rate hikes will have a manageable impact and not derail the economy from the wage-driven inflation process. A high proportion of households with net savings due to the aging society, together with the correction of yen weakness, will limit the damage to consumption. Decades of deleveraging has lowered the sensitivity of capex to a rate rise.

- The policy outlook faces high uncertainty. Financial market instability in early August invited criticism that the BoJ was too hasty to hike. Although a large chunk of yen carry trades appears to have been unwound for now, the BoJ may hesitate to hike rates if market instability relapses.

- Politics could become less supportive of rate hikes depending on who will succeed Prime Minister Fumio Kishida in September. While the unpopular yen weakness has receded for now, politicians may worry more about possible stock price correction and the rising damage to vulnerable but politically important agents, including hand-to-mouth households and micro enterprises.

Tags:

Related Posts

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More

Post

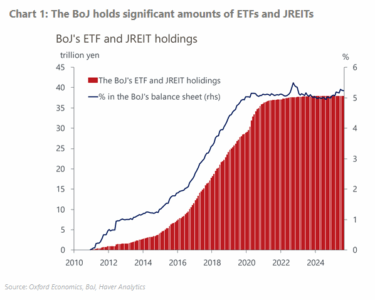

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More