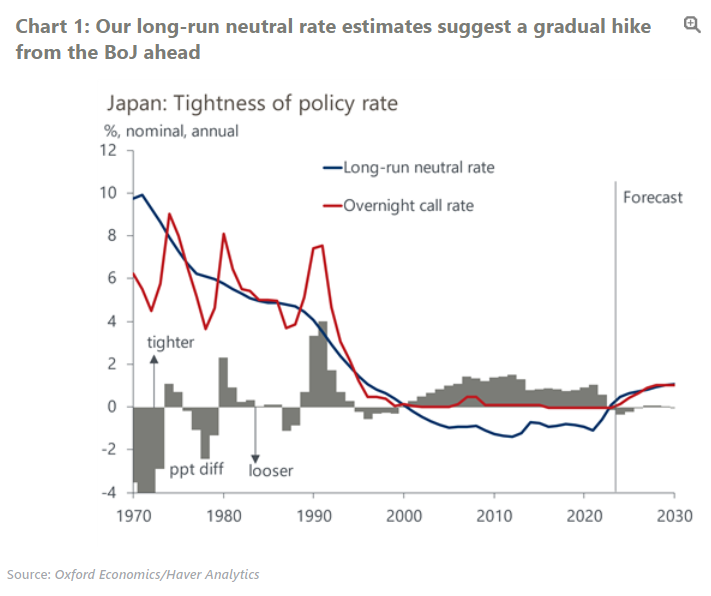

Japan’s neutral interest rate is rising, but not by much

We estimate that Japan’s nominal neutral interest rate – the rate consistent with monetary policy that is neither stimulative nor restrictive – has risen somewhat since 2022, marking a striking reversal from its decades-long slide. More importantly, we project it to continue rising gradually, to around 1% by 2030 from 0% in 2023.

What you will learn:

- Higher inflation expectations are one of the main reasons behind the recent increase in the nominal neutral rate. We believe that inflation expectations will continue to slowly edge up in the coming years amid robust wage gains, contributing to the projected neutral rate’s rise.

- Stripping out inflation expectations, the real neutral rate has risen only modestly in recent years. We think Japan’s demographic headwinds and weak productivity growth all but banish a sustained return to positive real neutral rates throughout our forecast to 2050. But in the next few years, increases in net foreign assets and the Bank of Japan’s step down in quantitative easing are likely to drive the rate slightly higher.

- Neutral rate estimates are inherently uncertain. Still, our approach provides a framework that can inform our view of the path for long-run interest rates, and our sensitivity and scenario analyses offer a useful gauge of the risks around our estimates.

Tags:

Related Posts

Post

Japan’s fiscal policy will remain loose, which increases risks to debt sustainabilit

We've changed our fiscal outlook for Japan in our December forecast round. We now expect the new government to set a primary deficit close to that of 2024, at 2%-3% of GDP for 2025-2027, instead of restoring a balanced budget by taking advantage of strong tax revenue. We assume higher bond yields will force the government to take measures to reduce the deficit from 2028.

Find Out More

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More