Japan’s BoJ rushed a rate hike without waiting for evidence

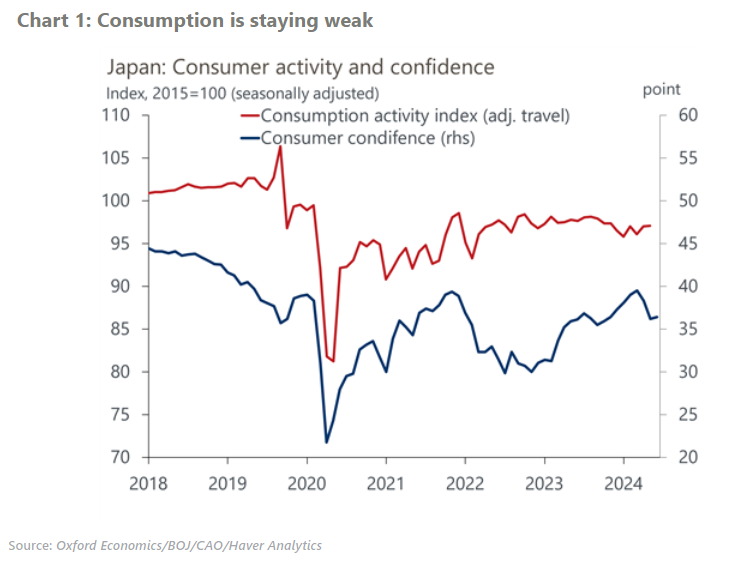

At Wednesday’s policy meeting, the Bank of Japan (BoJ) raised the policy rate to 0.25% without clear evidence of wage-driven inflation in wage and consumption data. Although CPI has stayed above 2%, the core-core CPI (excluding energy and fresh foods) has been easing.

What you will learn:

- The BoJ argued that recent data confirmed that the economy is on track for achieving the 2% inflation target as projected. The bank stressed that moves to raise wages “have been spreading across regions, industries, and firm sizes.”

- The BoJ revealed its plan for reducing JGB purchases which was in line with our projection. The bank will reduce monthly JGB purchases by ¥0.4trn every quarter from the current ¥6trn to reach ¥3trn in 1Q of 2026. Despite the substantial reduction in purchases, it will only reduce the BoJ’s JGB holdings by 7% and the share in outstanding JGBs to 45% from 48% by the end of FY2025.

- The statement said that “given that real interest rates are at significantly low levels, if the outlook in the July Outlook Report will be realized, the Bank will accordingly continue to raise the policy interest rate.” Based on this more hawkish policy reaction function, we will revisit our current projection to examine a chance of an earlier rate hike before spring next year.

Tags:

Related Posts

Post

Japan’s politics add uncertainty to BoJ policy outlook

The Bank of Japan (BoJ) kept its policy rate at 0.5% at its October meeting, after a 7-2 majority vote. Two board members again voted for a rate increase. We believe the BoJ will hike in December to 0.75% as incoming data confirm that the economy is performing in line with the bank's forecasts in its quarterly outlook. However, there's a material chance of a delay.

Find Out More

Post

Japan’s December rate hike appears likely, though there is a risk of delay

We've brought forward the timing of the next Bank of Japan (BoJ) 25bps rate hike to December from next year and have added another 25bps hike in mid-2026. This reflects the surprisingly hawkish shift in the BoJ's view since its September policy meeting and upward revisions to our growth and inflation projections, driven by the US economy's resilience.

Find Out More

Post

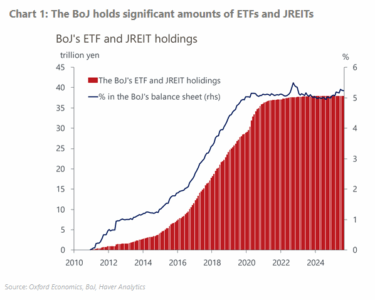

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More