Research Briefing

13 Nov 2025

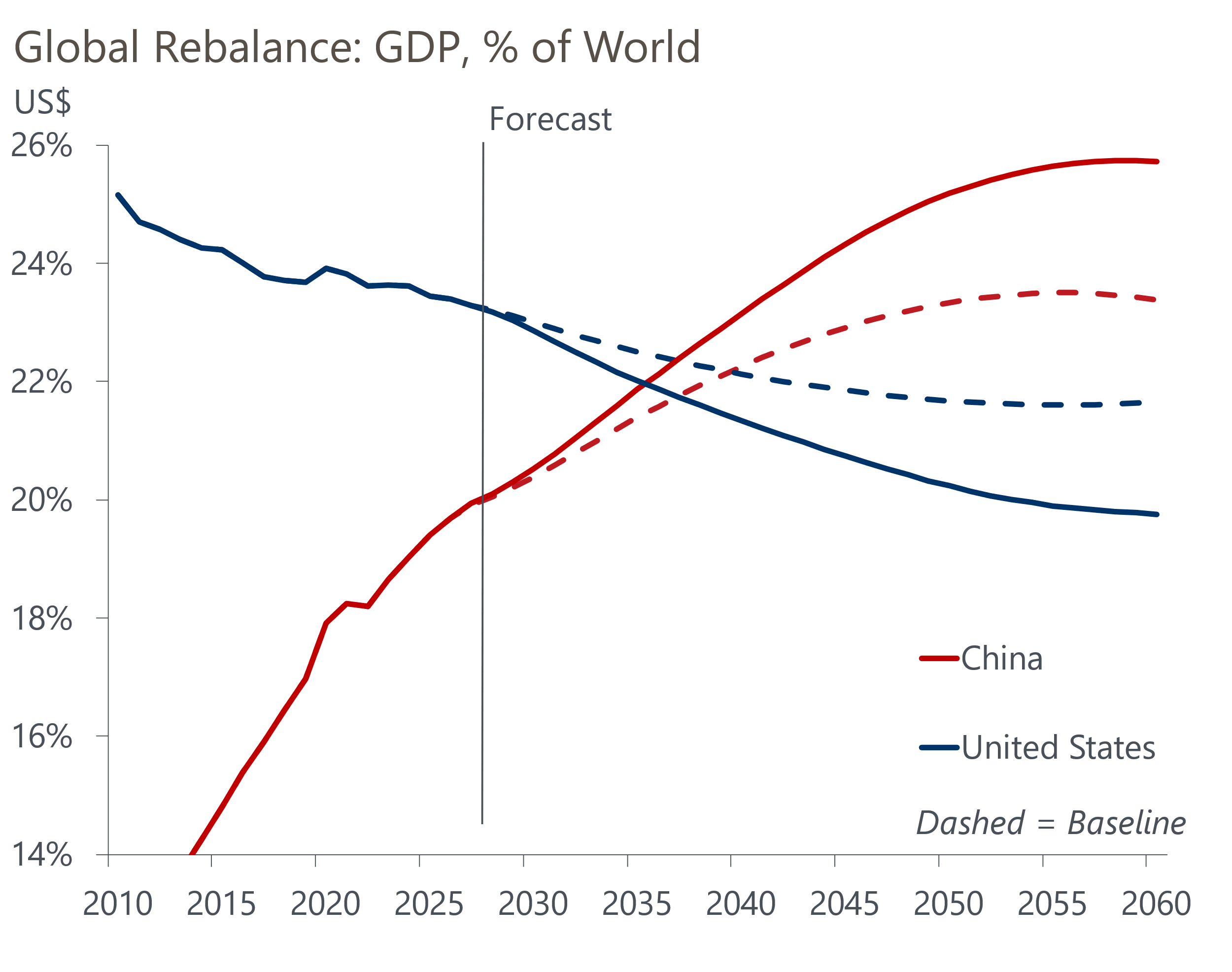

Shifting economic gravity in a Global Rebalance

The rebirth of US isolationism has raised fresh questions about the country’s role as the anchor of the global financial system. We’ve previously argued that US dollar dominance is unlikely to end this decade. And, even in the long run, our baseline view is that the US will rein in its growing fiscal deficit with painfully unpopular reforms during the 2030s, thereby avoiding a fiscal tipping point.

What you will learn:

- Our Global Rebalance scenario explores a gradual movement from a unipolar, dollar-based system to one with two centres of economic and financial gravity – the US and China – driven by weaker US policy credibility and Chinese structural reforms.

- In this scenario, confidence in US assets wanes into the 2030s as US government debt surpasses 180% of GDP and repeated political interference with the Federal Reserve undermines the central bank’s credibility. Slowly, investor trust erodes, capital flows reverse, risk premia rise, and the dollar weakens by around 20% as the US loses the benefits of its dominant-currency status.

- Meanwhile, China pursues successful reforms, loosening capital controls and improving transparency. A better pension system reduces the need for precautionary savings, the personal savings-to-disposable-income ratio falls to around 10% by 2060, and domestic consumption is 14% higher than baseline in real terms by 2060, aligning China with advanced economies.

- The outcome for the world economy is a more fragmented yet diversified global financial system. Economies closely linked to China’s ecosystem benefit, as do emerging markets dependent on Eurobonds, as they can hedge their borrowing across currencies.

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]