Research Briefing

13 Oct 2025

What happens if markets lose faith in the UK government’s fiscal approach?

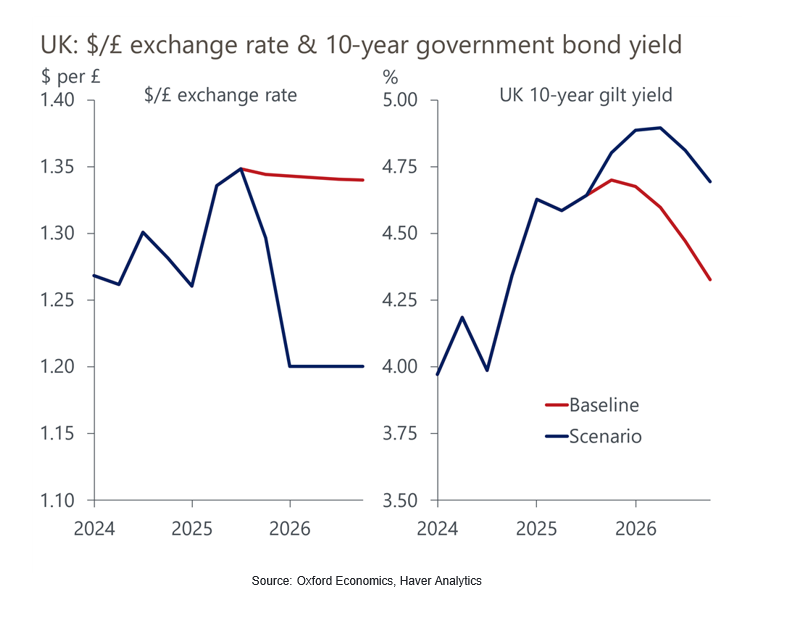

The Budget on November 26 will be a key test of market confidence in the UK government’s fiscal approach. If the government missteps and markets take fright, we think that sterling depreciation would accompany higher gilt yields.

What you will learn:

- We’ve used our Global Economic Model to construct a scenario where markets react negatively to the Budget. A weaker pound would exacerbate the UK’s inflation problems and discourage the Monetary Policy Committee from resuming rate cuts in early 2026. We think the government would then belatedly change its fiscal approach, cutting spending to try to restore confidence.

- Under this scenario, GDP would be 0.6ppts below our baseline forecast by the end of 2027. Consumers would be hit hard, with higher inflation adding to the squeeze on spending power. But the impact of a weaker pound on net trade would mitigate the hit to GDP.

- The UK’s fragile fiscal situation is a function of its high deficits, high inflation, and low growth. The government’s reliance on tax rises to lower borrowing is a key risk factor. Historically, revenue-based consolidations have a low success rate. Trying to raise large amounts of extra revenue from smaller taxes may also undermine the credibility of the government’s plan.

If markets lose faith, sterling could fall sharply alongside higher gilt yields

For more insight into this topic, watch our recent webinar ‘Stuck in a rut – is there any way out of the UK’s economic and fiscal problems?‘

You might also be interested in

Tags:

Download Report Now

[autopilot_shortcode]