Yen volatility – so far, just a tremor for global markets

Abrupt yen appreciations have been associated with, or preludes to, global financial instability. So far, the recent yen surge has had only moderate spillovers to global financial markets, which should not have significant macroeconomic effects. But the episode is not necessarily over and the possibility of further yen gains is a distinct risk.

What you will learn:

- The yen appreciated by around 7% against the US dollar in just a few days at the end of July and the start of August. Japanese stocks slumped by 20% during the same period. In association with some soft US data, this sent ripples through global markets. However, global financial markets have already regained much of their initial losses.

- Comparing the recent volatility to previous yen surges, we find the recent episode looks a lot less violent than the 1998 episode, which forced the US Federal Reserve to take emergency action.

- Further yen gains are a distinct possibility. Rate differentials with the US suggest the yen-US dollar exchange rate should be trading below JPY140/USD. Measures of long-term valuation suggest the yen remains undervalued. Moreover, history suggests a surging yen could overshoot fair value and move into overvalued territory.

- A possible channel for global financial instability is that large further yen gains lead to the unwinding of carry trades, which may have been as large as US$700bn-US$1tn. Such unwinding could lead to big losses for market participants and fire sales of other assets, including assets with very rich valuations, such as tech stocks.

Tags:

Related Posts

Post

What happens if markets lose faith in the UK government’s fiscal approach?

The Budget on November 26 will be a key test of market confidence in the UK government's fiscal approach. If the government missteps and markets take fright, we think that sterling depreciation would accompany higher gilt yields.

Find Out More

Post

The Digital Frontier—can the AI hype go on forever?

We believe that the current AI hype in financial markets will only be justified if companies can adopt AI quickly and effectively. In The Digital Frontier series, we will evaluate the state of AI and data centre investment and explore implications for different countries, cities, and sectors.

Find Out More

Post

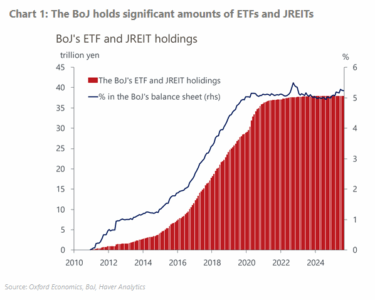

BoJ announces cautious plan to sell ETF and J-REIT holdings

At its monetary policy meeting on Friday, the Bank of Japan (BoJ) unexpectedly announced it would start to sell its ETF and Japanese real estate investment trust (J-REIT) holdings. We think the impact of this plan on financial markets will likely be limited because the BoJ is opting to play it safe in terms of the process and the scale.

Find Out More