Research Briefing

| Mar 4, 2024

Will Japan policy adjustments accompany the end of NIRP?

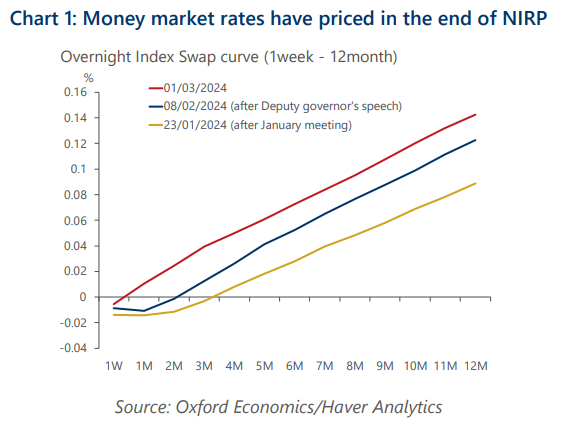

Markets appear to be increasingly converging with our forecast that the Bank of Japan will abolish its negative interest rate policy at the April meeting, after the spring wage settlement is confirmed, rather than in March. But views diverge on whether any other policy adjustments will accompany the end of NIRP.

What you will learn:

- We think the BoJ will introduce new forward guidance for short-term policy rates to avoid disruption from speculation. This guidance will mean that an effective zero interest rate policy continues until inflation is firmly back on a path towards the 2% inflation target, after a projected period of disinflation in the next few quarters caused by base-effects.

- We believe that the BoJ will wait for the outcome of the ongoing policy review sometime in autumn before abolishing the existing guidance on quantitative easing. This guidance commits the bank to “continue expanding the monetary base until the annual inflation of the observed CPI (excluding fresh food) exceeds 2% and stays above the target in a stable manner.”

- We believe that the yield curve control framework will remain as a safeguard to ensure stability in the exit process from QE, which will take several years. After making the framework less binding in October last year, maintaining YCC will do little harm to market-led rate formation in bond markets, given 10-year JGB yields will likely stay below the 1% ceiling for a few years.

Tags:

Related Services

No Posts Added