Why we lowered our China medium-term growth forecasts

The combined large shocks from years of regulatory uncertainty, the prolonged zero-Covid policy, and a housing correction have undermined China’s supply-side potential more than we previously anticipated. We have therefore cut our estimates of China’s future potential GDP growth rates.

What you will learn:

- Despite slowing, we still expect China’s economy to eventually converge with the US in GDP size by the mid-2030s. However, the bigger challenge for policymakers in the coming years is growth sustainability.

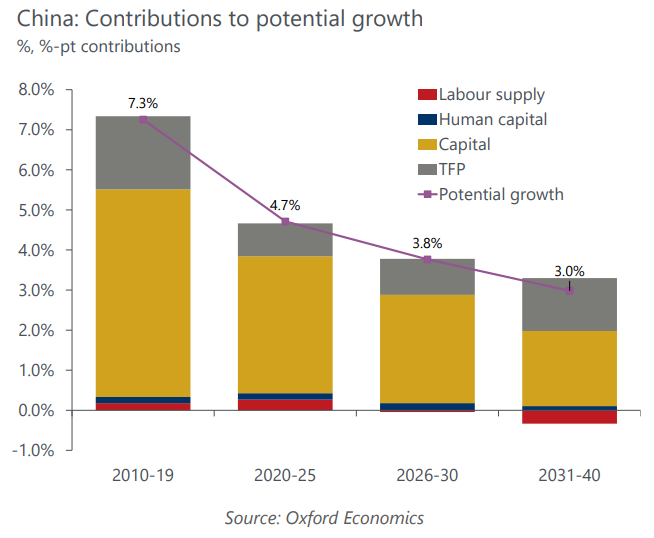

- As the economy rebalances slowly towards a consumption-driven growth model – so a moderation in the contribution from capital – and amid a decline in the working age population, the outlook for China’s trend growth depends to a large extent on raising total factor productivity (TFP). Our base case assumes that continued reforms and the uptrend in R&D spending drive a recovery in TFP in the coming decades.

- The risks to our already-cautious forecasts are still moderately skewed to the downside, particularly if the pace of capital accumulation slows more than we anticipate. Geopolitical tensions leading to more restricted access to technology will also pose a risk to productivity growth.

Tags:

Related Posts

Post

A reality check on the status of RMB internationalisation

The recent geopolitical shocks and abrupt US policy shifts have heightened concerns about the stability of the dollar-centric global financial system and strengthened the perceived need for diversification.

Find Out More

Post

China and AI underpin stronger global trade outlook

Global trade is set for a stronger-than-expected rebound, supported by lower US tariffs, continued AI-driven investment, and China’s renewed export push. Our latest forecasts show upgrades to both nominal and volume trade growth in 2025–26, even as legal uncertainty surrounding US tariff mechanisms and evolving geopolitical dynamics pose risks to the outlook.

Find Out More

Post

China’s Outbound Recovery: Slowing but Still Rising

Research Briefing Why we lowered our China medium-term growth forecasts The rebound continues, but slowing demand, economic headwinds, and shifting traveler preferences are reshaping the outlook.

Find Out More